23 September 2024

23 September 2024Week 38 – Pepper / Summary

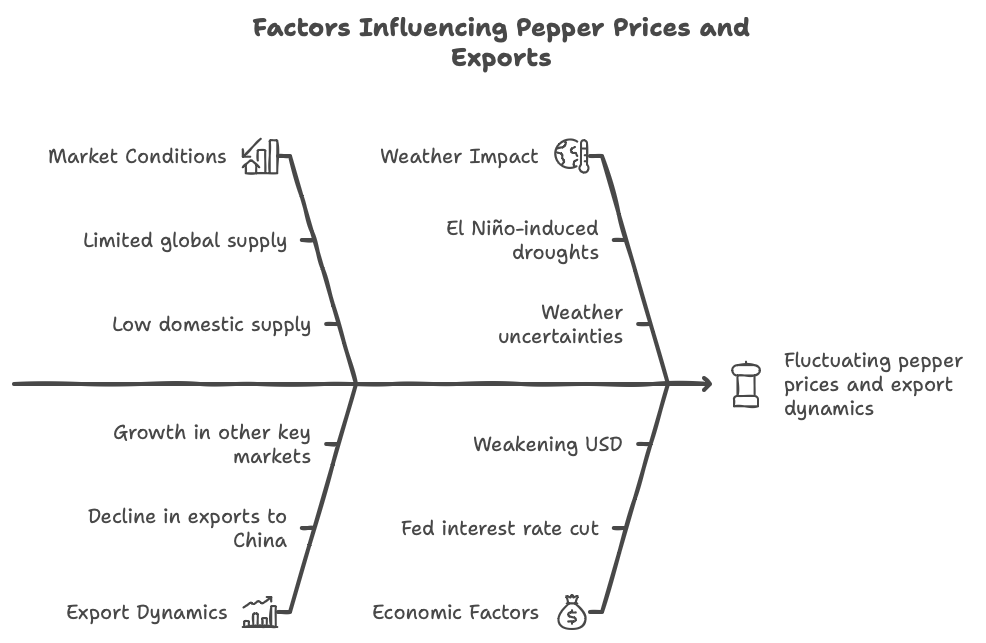

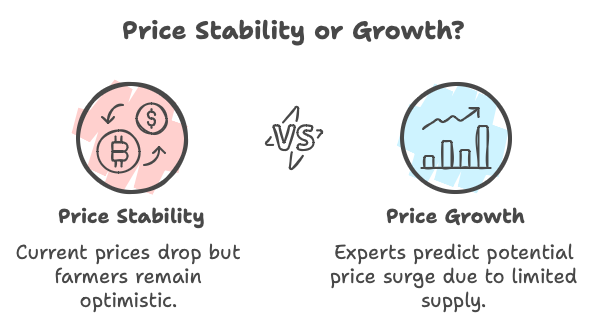

Pepper prices dropped by 2,000 – 3,000 VND/kg across various regions. However, farmers are optimistic as current prices provide encouragement ahead of this year’s harvest season. Experts predict pepper prices could surpass 160,000 VND/kg before Vietnam’s harvest begins, driven by limited global supply.

Vietnam’s pepper exports to most key markets have grown by double digits, except for China. According to the Vietnam Pepper and Spices Association (VPSA), exports to China in the first eight months only reached 8,388 tons (valued at $23.5 million), a sharp decline of 84.4% in volume and 80.2% in value compared to the same period last year. China’s share of Vietnam’s total pepper exports dropped from 28.6% last year to 4.6%, making it the fifth-largest market, down from its top position in 2023.

The recent Fed interest rate cut had little impact on domestic pepper prices, while the weakening USD supported price increases in other countries. Experts note that the market remains quiet due to low supply, as most of the recent harvest has already been exported, leaving the market reliant on limited reserves.

In the first 15 days of September 2024, Vietnam exported 6,917 tons of pepper, generating $42.3 million. This is a significant drop (about 30%) compared to the first half of August, when exports reached 10,082 tons and $58.8 million.

Looking ahead, experts believe global pepper production will not meet rising demand over the next 3 to 5 years. While short-term price breakthroughs may be unlikely, there were positive signs towards the end of last week. Countries like Indonesia and India are also facing supply constraints, and key producers like Brazil and Vietnam are struggling with reduced output due to El Niño-induced droughts. Although production in Vietnam is expected to rise next year, weather uncertainties make future predictions challenging.

In the long term, global pepper production is unlikely to meet consumer demand for the next 3-5 years.