Week 51 – Vietnam / Global Pepper Market Update: Prices, Trends, and Export Insights

Vietnam’s Domestic Pepper Market Overview

Vietnam’s domestic pepper market shows prices ranging from 149,000 to 150,000 VND/kg in key growing areas. This benchmark significantly influences both local farmers and international buyers, impacting global pepper pricing. A stable domestic market is crucial for Vietnam’s global pepper supply chain. Current prices reflect production costs, local demand, and the overall health of the nation’s agriculture.

Global Market Insights and Export Projections

Short-Term Market Outlook

According to the Import-Export Department, the global pepper market is experiencing a temporary price decline. However, this trend is expected to reverse due to increased year-end consumption, providing a positive outlook for global pepper prices. This anticipated upturn is crucial for exporters and importers planning their strategies for the coming months.

Vietnam’s Export Challenges and Opportunities

Vietnam’s pepper exports may face challenges in the final months of 2024 due to limited domestic supply and low demand from China. However, exports are expected to improve in early 2025 as Chinese demand rises. This projection highlights the importance of market diversification and the need for exporters to adapt to changing market conditions.

The global pepper market’s volatility underscores the need for stakeholders to stay informed about market trends and be prepared to adjust their strategies accordingly. Factors such as changing consumer preferences, geopolitical events, and climate conditions can all impact the pepper trade. As such, exporters and importers should maintain flexibility in their operations and consider hedging strategies to mitigate risks associated with price fluctuations.

*While the market appears stable, challenges remain. Climate variability and the need for sustainable farming practices impact crop yields and long-term productivity. Despite this, Vietnam’s pepper industry remains a cornerstone of its agricultural exports, supporting rural economies.

Vietnam’s Export Performance and Key Markets

Vietnam’s pepper export performance from January to November 2024 showcases both challenges and opportunities in the global market. During this period, Vietnam exported 235,335 tons of pepper, generating revenue of $1.22 billion. While the export volume decreased by 3.5% year-over-year, the export value surged by an impressive 46.9%, primarily driven by higher prices.

International Pepper Market Updates

The global pepper market is characterized by diverse trends across different regions and producing countries. Recent updates from the International Pepper Community (IPC) and other sources provide valuable insights into the current state of the international pepper trade.

Indonesian Black Pepper

The latest trading session reported by the IPC saw Lampung black pepper from Indonesia priced at $6,822 per ton, remaining unchanged from the previous session. This stability in pricing indicates a consistent demand for Indonesian pepper in the global market.

Brazilian Pepper Exports

Brazil exported 4,302 tons of pepper worth $28 million in November 2024, marking an 18.8% increase in volume and a 19.6% increase in revenue compared to October. The United States was Brazil’s largest export market in November, importing 850 tons, followed by Germany (464 tons) and Pakistan (433 tons). Notably, Vietnam ranked eighth, importing 251 tons of Brazilian pepper.

These international updates highlight the interconnected nature of the global pepper trade, with countries like Indonesia, Brazil, and Vietnam playing significant roles as both exporters and importers. The varied export destinations for Brazilian pepper demonstrate the global demand for this spice and the importance of maintaining diverse trade relationships in the pepper industry.

U.S. Pepper Import Trends and Market Analysis

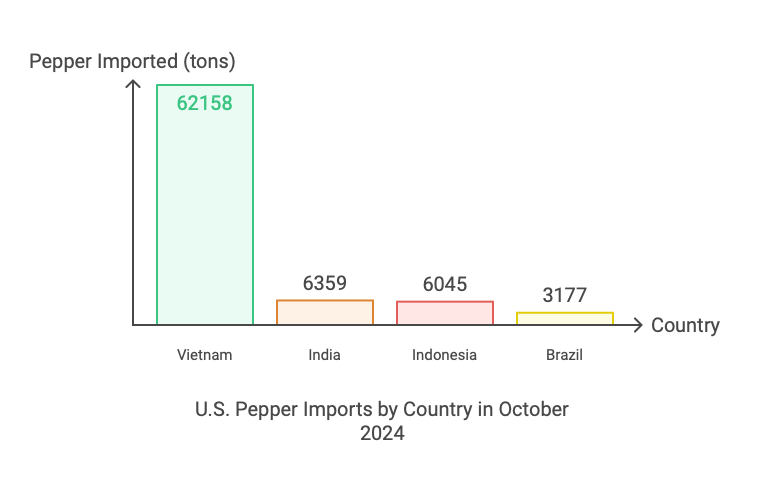

The United States, as the world’s largest pepper importer, plays a crucial role in shaping global pepper trade dynamics. Recent data from October 2024 reveals significant growth in U.S. pepper imports, both in volume and value.

*Other significant suppliers to the U.S. market include India (6,359 tons, +25% YoY), Indonesia (6,045 tons, +90.3% YoY), and Brazil (3,177 tons, +73.8% YoY).

*Other significant suppliers to the U.S. market include India (6,359 tons, +25% YoY), Indonesia (6,045 tons, +90.3% YoY), and Brazil (3,177 tons, +73.8% YoY).

This substantial growth in imports is attributed to several factors:

- Easing inflation in the U.S. economy

- Looser monetary policies encouraging trade

- Anticipation of potential economic policy shifts following the upcoming U.S. presidential election

- Importers stockpiling inventory in preparation for future market changes

The robust growth in U.S. pepper imports signifies a recovering market after two years of decline. This trend presents significant opportunities for pepper-exporting countries, particularly Vietnam, which maintains a dominant position in the U.S. market. However, the increasing market shares of other countries like India, Indonesia, and Brazil indicate growing competition, emphasizing the need for exporters to maintain quality standards and competitive pricing.

Conclusion and Future Outlook

The global pepper market continues to demonstrate resilience and dynamism, with Vietnam maintaining its position as a key player despite facing challenges in some markets. The positive outlook for global pepper prices, driven by anticipated increased year-end consumption, offers a ray of optimism for exporters worldwide.

Vietnam’s export performance, marked by a significant increase in value despite a slight decrease in volume, highlights the importance of value-added strategies and market diversification. The strong growth in exports to the United States and emerging markets underscores the potential for further expansion and the need for adaptable export strategies.

In conclusion, while the pepper market faces challenges such as price volatility and changing demand patterns, it also presents significant opportunities for growth and innovation. Stakeholders who remain adaptable, focus on quality, and leverage market intelligence will be well-positioned to thrive in this dynamic global marketplace.