2025 // Week 7 – Vietnam Pepper Market: Price Surge, Supply Concerns, and Future Outlook

Domestic Pepper Prices Experience Significant Surge

Pepper prices in key regions of Vietnam have experienced a notable surge, reaching levels of 165,000 to 166,000 VND/kg. This increase marks a continuation of the upward trend observed after the Lunar New Year celebrations. The timing of this price surge coincides with the early stages of the harvest season, bringing a sense of optimism and renewed hope to local pepper farmers who have faced challenges in recent years. This development suggests a potentially favorable turn for the domestic pepper market, offering better returns for producers amidst evolving global dynamics.

The price increase reflects a complex interplay of factors, including increased demand, anticipation of lower yields due to adverse weather conditions, and strategic adjustments by farmers in response to changing market signals. As the harvest progresses, monitoring these price movements will be crucial for stakeholders to optimize their trading strategies and ensure stable supplies.

Declining Cultivation Area: A Growing Concern

The area dedicated to pepper cultivation in Vietnam has been steadily declining, raising concerns about future production volumes. In 2024, the total cultivation area is estimated at 113,000 hectares, with an expected yield of 190,000 tons. This represents a decrease compared to the 115,000 hectares recorded in 2023. The peak cultivation year was 2017, with an impressive 151,900 hectares under pepper cultivation. Projections indicate a further potential decrease, with the area possibly dropping to around 110,000 hectares.

Several factors contribute to this decline, including adverse weather conditions, the prevalence of pests and diseases affecting pepper plants, and the increasing profitability of alternative crops such as durian and coffee. As farmers seek more lucrative options, the shift away from pepper cultivation poses a challenge to maintaining stable production levels. Addressing these issues through improved farming practices, pest control measures, and diversification strategies will be essential to mitigate the impact of the declining cultivation area.

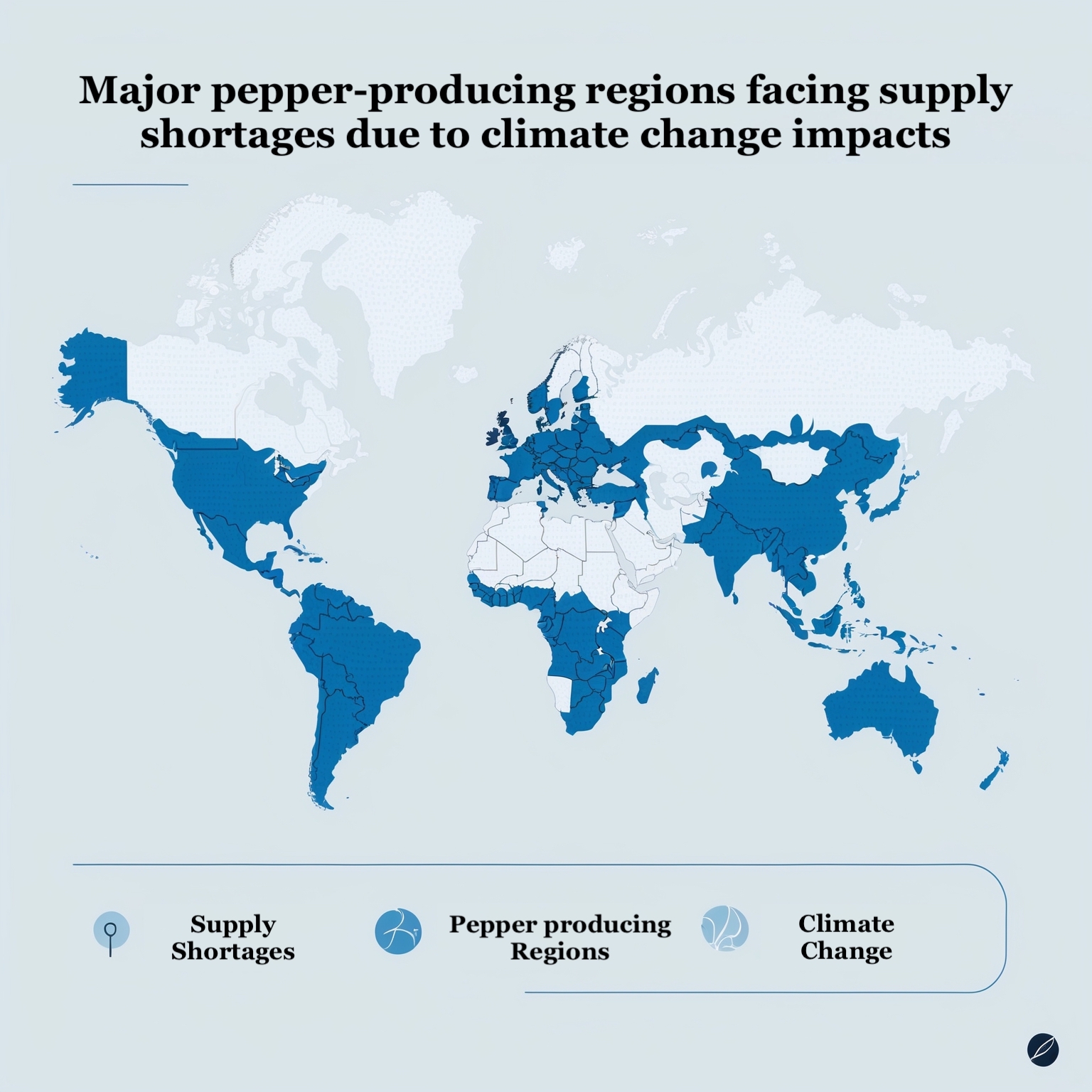

Global Supply Shortages and Climate Impact

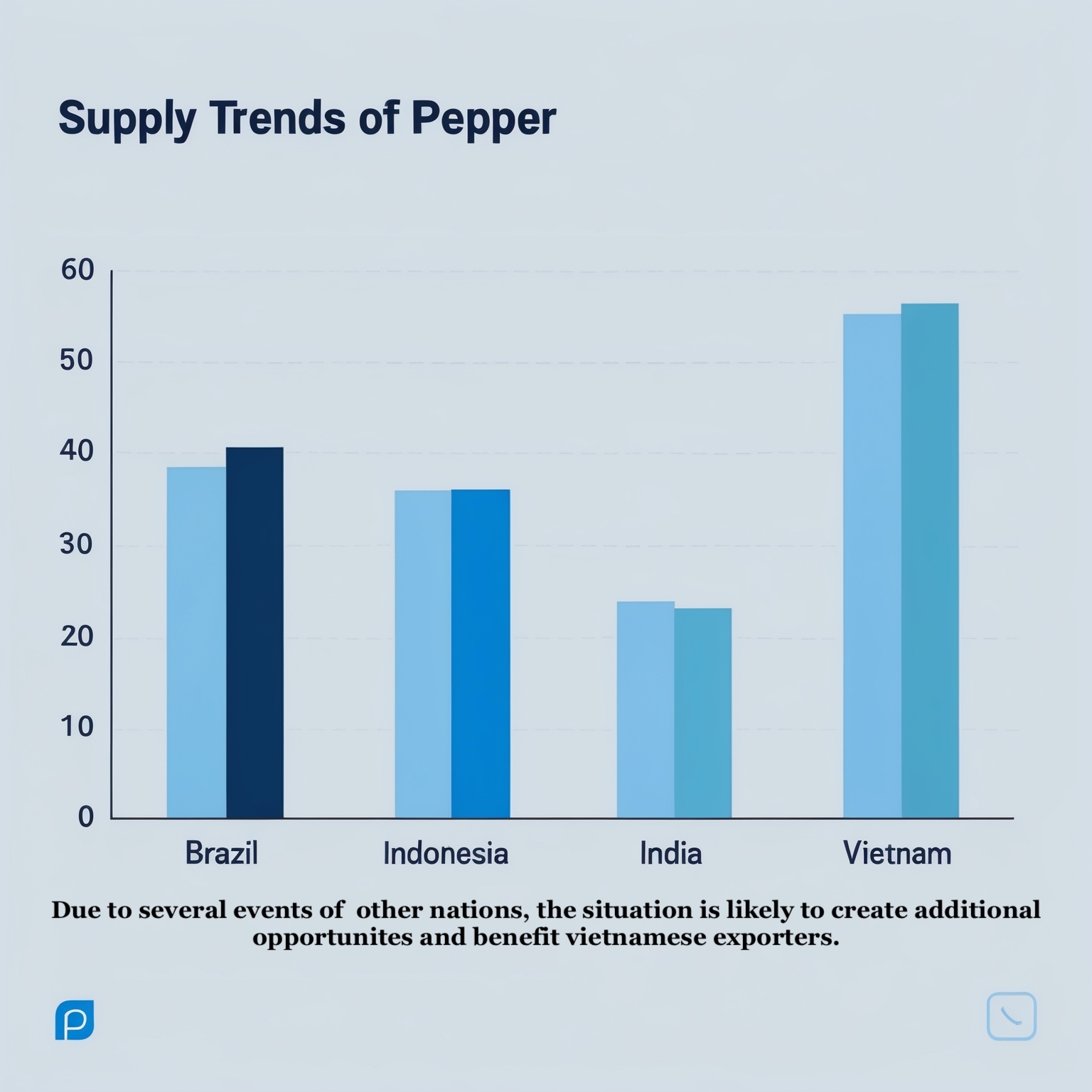

The global pepper market is facing potential supply shortages, exacerbated by adverse climate conditions impacting major producing nations. Projections for 2025 indicate a further decline in global production, continuing a three-year trend. Extreme weather events are affecting key pepper-growing regions in countries such as Indonesia, India, Malaysia, Sri Lanka, and Brazil. These disruptions are contributing to tighter supplies, which may push prices higher in the international market. The combination of reduced cultivation areas in Vietnam and global supply constraints paints a complex picture for the future of pepper production and trade.

*Picture for illustration purposes only

Vietnam’s Strategic Shift Towards Quality and Diversification

In response to the evolving market dynamics, Vietnam is strategically shifting its focus from expanding cultivation areas to enhancing the quality of its pepper production. This approach involves implementing advanced farming techniques, improving post-harvest processing methods, and adhering to stringent quality control measures. Furthermore, Vietnam is actively pursuing market diversification to reduce its reliance on specific export destinations. By exploring new markets and catering to diverse consumer preferences, Vietnam aims to strengthen its position in the global supply chain and enhance the competitiveness of its pepper exports.

Export Outlook for 2025: Positive Conditions Expected

The export outlook for Vietnamese pepper in 2025 is generally positive, with expectations of sustained high prices driven by tight global supply and steady demand. However, price fluctuations will likely depend on the buying behavior of major importers, particularly the United States and China. Market analysts predict potential price increases of 10-15%, contingent on these demand dynamics. China, in particular, is expected to resume strong purchasing activity as its pepper stock levels remain relatively low, which should further bolster export prospects for Vietnam.

Despite the optimism, uncertainties remain regarding the intensity and timing of demand from these key markets. Monitoring their import policies, consumption patterns, and inventory levels will be crucial for Vietnamese exporters to make informed decisions and capitalize on emerging opportunities. Furthermore, proactive engagement with trade partners and participation in international exhibitions can help expand market access and solidify Vietnam’s position as a reliable pepper supplier.

Competing Nations and Supply Trends: A Comparative Analysis

Price Forecast for 2025 and Key Considerations

Pepper prices are expected to remain high throughout 2025 due to the prevailing combination of tight global supply and sustained demand. However, market movements will be significantly influenced by the purchasing decisions of major buyers, primarily China and the United States. Monitoring their import volumes, trade policies, and consumption trends will be crucial for predicting short-term price fluctuations. Additionally, unexpected weather events or policy changes in key producing nations could introduce volatility into the market, requiring careful risk management strategies.

For Vietnamese pepper producers and exporters, focusing on quality, diversifying export markets, and building strong relationships with trade partners will be essential to navigate these challenges and capitalize on emerging opportunities.