2025 // Week 30 – Vietnam Pepper Market Update: Prices, Export-Import Performance and Market Outlook

Domestic Pepper Price Trends

Domestic pepper prices this morning (July 21) remained stable compared to the previous day, fluctuating within the range of 140,000 – 143,000 VND/kg. However, when compared to last week’s figures, the market has experienced a modest decline of approximately 1,000 – 2,000 VND/kg on average across most regions.

Notably, the Dak Nong region has shown exceptional stability, maintaining consistent price levels with no recorded changes during this period. This regional variation highlights the localized nature of pepper pricing factors within Vietnam’s diverse growing regions.

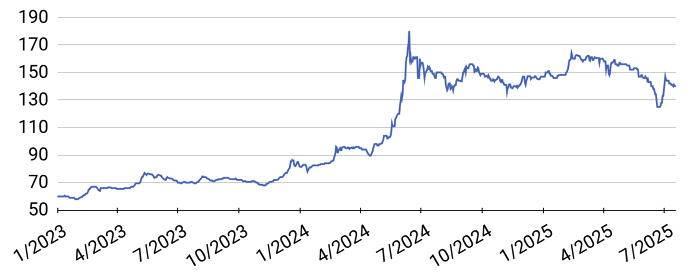

Pepper price developments in the Central Highlands and Southeast from First 2023 to July 21, 2025 (Unit: VND/kg)

Export Performance Analysis

According to preliminary data from the Vietnam Pepper and Spice Association (VPSA), Vietnam’s pepper exports have shown concerning declines in the first 17 days of July 2025. The country exported 10,808 tons of various pepper types, generating a turnover of 70.3 million USD. This represents a significant decrease of 7.8% in volume and 11.1% in turnover compared to the same period in the previous month.

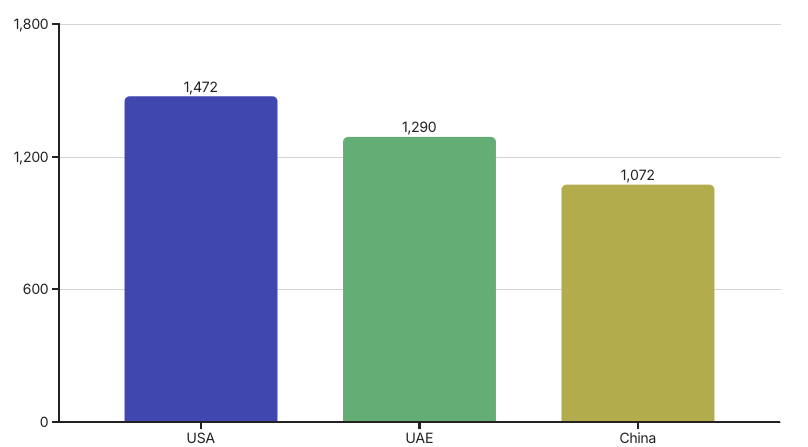

The United States continues to be Vietnam’s largest pepper market, importing 1,472 tons during this period. Following closely are the United Arab Emirates with 1,290 tons and China with 1,072 tons. The Chinese market has shown particularly troubling trends, with imports nearly halving compared to the first 17 days of June when China purchased 1,904 tons of Vietnamese pepper. Market analysts attribute this sharp decline to persistently weak demand and a lack of clear recovery signals from the Chinese market.

Export pricing has also weakened, with the average export price in early July reaching 6,500 USD/ton, noticeably lower than the first half of the year’s average of 6,881 USD/ton. This price erosion further compounds the challenges facing Vietnam’s pepper export sector.

Import Trends and Analysis

In stark contrast to export performance, Vietnam’s pepper imports have experienced a dramatic decline in the first 17 days of July 2025. The country imported just 1,738 tons of pepper with a corresponding turnover 12.2 million USD. This represents a substantial decrease of 53.2% compared to the same period in June, indicating a significant shift in Vietnam’s pepper trade dynamics.

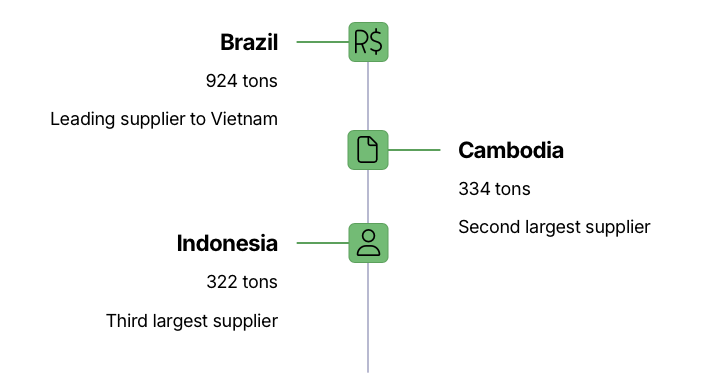

Brazil has emerged as Vietnam’s primary pepper supplier during this period, accounting for 924 tons of imports. Cambodia follows as the second-largest supplier with 334 tons, while Indonesia ranks third with 322 tons. This import pattern reflects Vietnam’s strategic sourcing approach, balancing regional proximity with quality and price considerations from more distant suppliers like Brazil.

Market Outlook and Future Projections

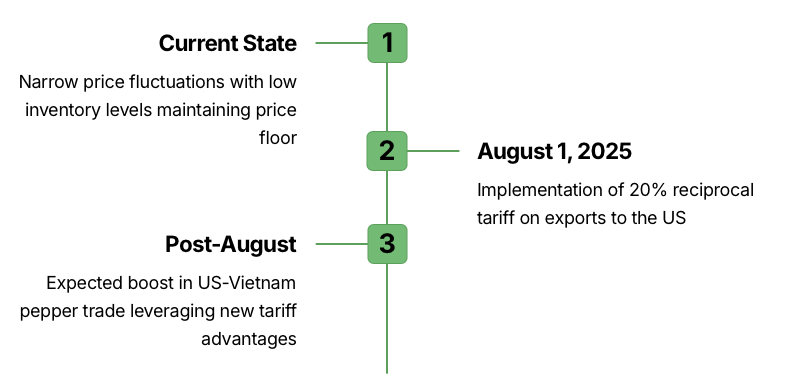

Market experts anticipate that pepper prices will continue to fluctuate within a relatively narrow range in the short term. The current low inventory levels are providing crucial support for the price floor, preventing any dramatic downward movements. However, cautious sentiment continues to dominate market activity, with buyers and sellers alike showing restraint in their trading decisions.

A significant market catalyst is expected after August 1, 2025, when the 20% reciprocal tariff on exports to the United States officially takes effect. This policy change represents a potential turning point for Vietnam’s pepper industry, as businesses are positioning themselves to leverage this export advantage to boost trade with the American market, which already stands as Vietnam’s largest pepper destination.