2025 // Week 31 – Vietnam Black Pepper Market Analysis: Current Trends and Future Outlook

Current Price Dynamics and Market Performance

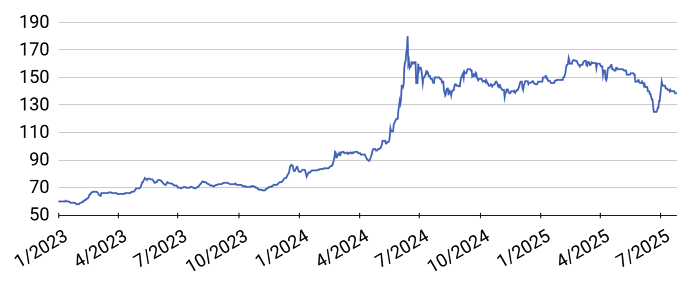

Vietnam’s domestic black pepper market has witnessed remarkable price elevation in 2025, with current rates ranging between 138,000 and 141,000 VND/kg. This represents a near 100% increase compared to the same period in 2024, creating significantly improved economic conditions for farmers and domestic suppliers. The substantial price growth stems primarily from a fundamental supply-demand imbalance in the global pepper market.

Global consumption has maintained stability with slight upward momentum despite economic headwinds in some importing regions. This resilient demand pattern contrasts sharply with the notable decline in overall supply compared to 2024 levels. The resulting market tightness has created persistent upward pressure on prices throughout the first half of 2025.

Pepper price developments in the Central Highlands and Southeast from First 2023 to July 28, 2025 (Unit: VND/kg)

The sustained high price environment has begun influencing producer behavior across Vietnam’s pepper-growing regions. Unlike previous years characterized by post-harvest panic selling to generate immediate cash flow, many farmers now enjoy improved financial positions thanks to the elevated price levels. This enhanced financial security has allowed producers to hold inventory and time their market entries more strategically, further reinforcing price stability

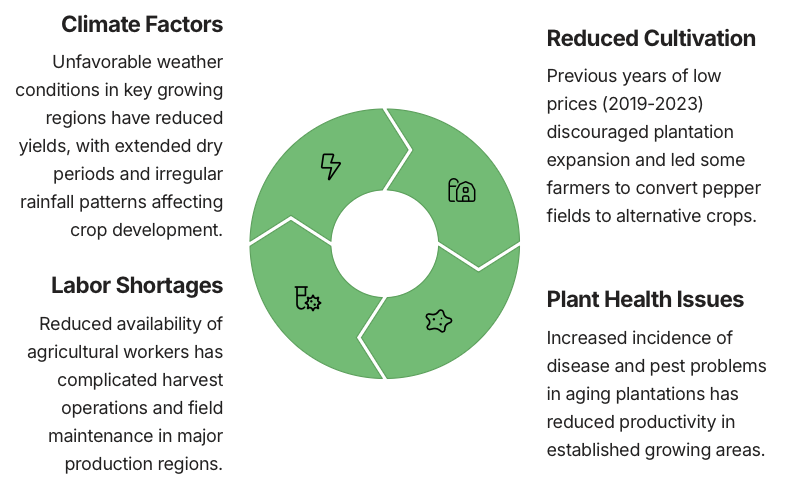

Supply Constraints Driving the Market

The significant price elevation in Vietnam’s black pepper market stems primarily from persistent supply constraints that have tightened availability throughout the global supply chain. Current production volumes remain insufficient to meet global demand, creating a fundamental market imbalance that continues to support high price levels.

The current supply limitations have proven difficult to address in the short term due to pepper’s biological growth cycle. Even with the recent expansion of cultivation areas motivated by higher prices, new plantings require 2-3 years to reach commercial production capacity. This inherent delay in supply response creates a medium-term outlook where supply constraints will likely persist through 2026, maintaining favorable price conditions for existing producers.

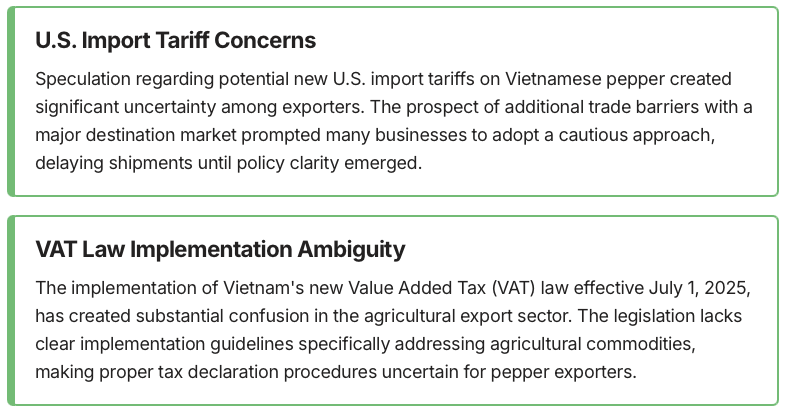

Regulatory Challenges Affecting Market Activity

The Vietnam pepper market has faced significant regulatory headwinds in mid-2025 that temporarily disrupted normal trading patterns. According to industry experts at the Vietnam Pepper and Spice Association (VPSA) Mid-Year Review Conference held on July 24, two key policy concerns have contributed to recent market hesitation and transaction delay

The tax policy ambiguity has proven particularly problematic for the export supply chain. Without clear guidance on VAT application, exporters have faced difficulties in completing proper tax declarations, creating administrative bottlenecks that slowed processing times. This uncertainty has cooled domestic transaction volumes as businesses await regulatory clarification before committing to large-volume purchases.

Industry associations have been actively engaging with government authorities to seek clarification on these regulatory issues. The VPSA has conducted multiple information sessions for members and submitted formal requests for implementation guidelines from the Ministry of Finance. Market analysts expect that once these regulatory ambiguities are resolved, normal transaction volumes will resume, supported by the fundamentally strong international demand.

Market Recovery and Price Stabilization

Following the brief period of market hesitation caused by regulatory uncertainty, Vietnam’s pepper market has demonstrated remarkable resilience with a decisive recovery beginning in late June 2025. Prices rebounded to approximately 140,000 VND/kg and have maintained stability at these elevated levels through July and early August.

Several factors have contributed to this price stabilization despite earlier concerns:

- Improved clarity on some regulatory questions, particularly regarding U.S. trade policy, which has reduced exporter uncertainty

- Continued tight global supply conditions reinforcing the fundamental supply-demand imbalance

- Strategic inventory management by farmers with improved financial positions from higher prices

- Persistent international demand signals, particularly from food manufacturing sectors

The absence of post-harvest panic selling represents a significant shift in market dynamics compared to previous years. Historically, many pepper farmers would sell substantial portions of their harvest immediately after collection to address immediate cash flow needs, creating temporary price suppression. In 2025, the enhanced financial position of producers from sustained high prices has eliminated this pressure, allowing for more measured and strategic market entries that support price stability.

Market analysts note that this price stability is occurring despite the traditional seasonal pressure that often accompanies harvest periods. This resilience suggests a fundamental shift in market structure, with supply constraints exerting greater influence than seasonal patterns. The current price stability reinforces expectations that the high-price environment will persist at least through the remainder of 2025 and likely into early 2026.

International Demand Patterns and Export Outlook

Despite the elevated price environment, international demand for Vietnamese pepper has demonstrated remarkable resilience throughout 2025. Global consumption patterns have remained stable with slight upward momentum, particularly in developed markets where pepper usage in food processing and retail segments continues to grow despite broader economic uncertainties.

The U.S. market is expected to significantly increase order volumes in Q4/2025 and Q1/2026 as importers begin rebuilding inventories for the peak consumption season. American food processors and spice companies typically increase purchasing during this period to ensure adequate supply for holiday season production and winter retail demand. With U.S. warehouse stocks currently at multi-year lows, this seasonal buying is anticipated to be particularly strong, providing additional support for Vietnamese export prices.

Agricultural authorities and industry experts emphasize that despite the current expansion activities, these new plantings will not materially impact global supply until at least 2027-2028. The multi-year maturation period for pepper vines means that current planting decisions will only influence market conditions in the medium term, offering little relief for the immediate supply constraints driving current prices.

Additionally, market analysts note that the cyclical nature of agricultural commodity markets suggests caution is warranted regarding excessive expansion. Historical patterns indicate that significant supply increases can eventually lead to price corrections, creating potential future challenges if expansion is not managed carefully across producing regions.