2025 // Week 32 – Vietnam Pepper Market: Price Stability, Production Forecasts, and Trade Dynamics

Vietnam Current Price and Production Outlook.

Domestic pepper prices have maintained remarkable stability in recent months, fluctuating within a narrow band of 139,000 – 143,000 VND/kg. This price stability comes despite seasonal transitions and varying global demand signals, indicating well-balanced market fundamentals in the short term. Vietnam, as the world’s largest pepper producer, is experiencing the initial phase of its rainy season with encouraging developments. According to the June bulletin released by the International Pepper Community (IPC), the flowering process for Vietnamese pepper plants is progressing positively. This critical reproductive stage sets the foundation for potential yield in the upcoming season, with preliminary forecasts for the 2026 crop appearing promising. However, climate challenges persist as a significant risk factor. Prolonged heatwaves in the region could potentially compromise plant vitality and adversely affect yield formation. Vietnamese pepper cultivation is particularly vulnerable to extended periods of high temperatures, which can stress the plants during critical development phases and reduce their productive capacity.

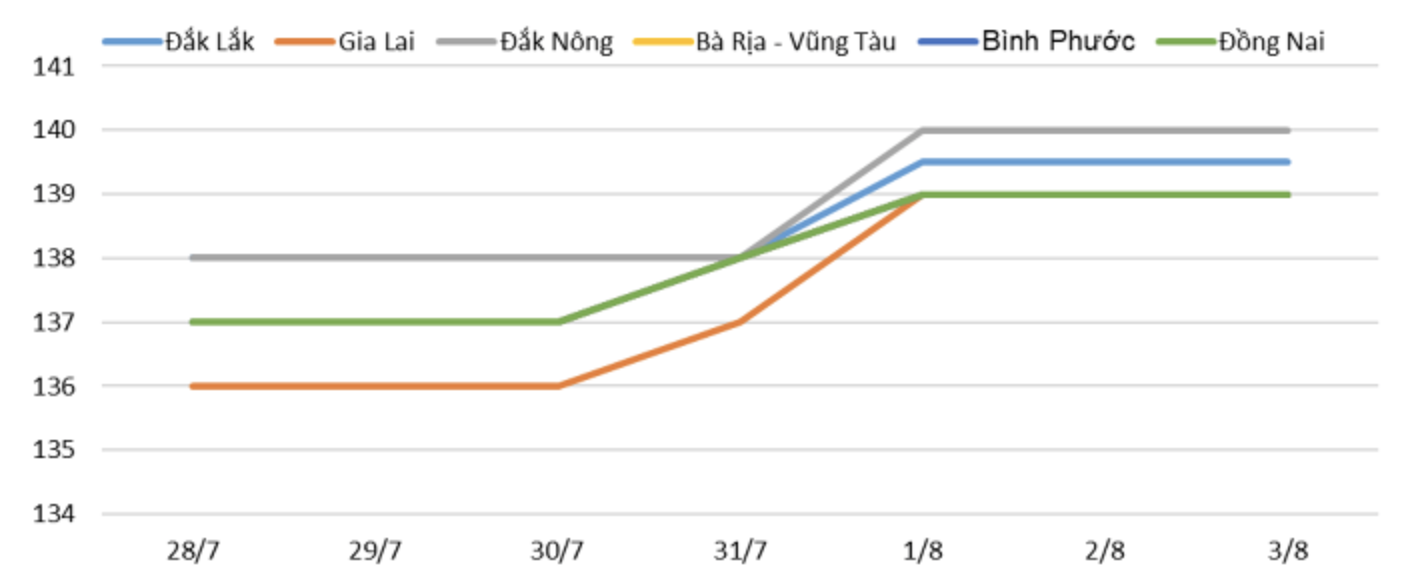

Pepper price developments in the Central Highlands and Southeast regions during the week from July 28 to August 3, 2025

*Source: VPSA – Vietnam Pepper and Spice Association

Indonesian Production Challenges and Market Implications

Indonesia, the world’s second-largest pepper producer, is facing significant production headwinds according to industry observers. Initial field observations have identified a concerning decreasing trend in crop yield potential. Industry members have provided estimates suggesting a potential reduction of up to 30% compared to previous harvest cycles. This substantial decline could reshape regional supply dynamics and influence global price trajectories. The Indonesian pepper harvest calendar indicates collection will commence from late July and continue through mid-August. This timing positions Indonesian exports to increase during the late summer period, potentially providing some market relief. However, a critical counterbalance exists in the form of robust domestic consumption within Indonesia itself. Strong local demand for pepper within Indonesia could significantly reduce the inventory available for export to international markets. This domestic absorption of production creates an important market dynamic where even with an active harvest period, the exportable surplus may be considerably constrained.

The combined effect of reduced production and strong domestic consumption creates a compound pressure on Indonesia’s ability to maintain consistent export volumes. This supply constraint from a major producer could become a significant factor in maintaining or potentially increasing global pepper prices, depending on how other producing regions respond.

Brazilian Harvest Expectations and Global Supply Coordination

Brazil’s position in the global pepper market is set to evolve as the northern region prepares for its harvest season beginning in September. Brazilian exporters are actively making preparations to release inventory to international markets from this period onward, potentially influencing global supply dynamics and price stability in the fourth quarter of 2025.

Current inventory assessments indicate limited available stock in Brazil, creating a supply constraint until the new harvest materializes. This temporary tightness in Brazilian supply could contribute to maintaining price levels in the intervening period, particularly if demand remains consistent or increases. The International Pepper Community’s market assessment suggests an overall increasing supply trajectory for the latter half of 2025. This projection is based not only on production outputs from major growing regions but also considers several critical factors:

The second half of 2025 is expected to witness more active market participation from producing nations. Their ability to capitalize on market opportunities will depend significantly on their flexibility in responding to changing conditions and their capacity to make informed strategic decisions regarding inventory management, pricing, and export timing.

Indian’s Trade Policy Impacts on Competitive Positioning

Recent developments in U.S. trade policy have introduced significant competitive disruptions to the global pepper market that could reshape trading patterns and supplier relationships. According to reporting from The Hindu Business Line, Indian exporters have expressed serious concerns regarding the implementation of a 25% tariff by the administration of U.S. President Donald Trump on various spice imports from India.

This substantial tariff places Indian spice exports—including pepper, turmeric, and ginger—at a distinct competitive disadvantage in the U.S. market compared to products originating from Vietnam and Indonesia. The ASEAN region producers benefit from more favorable tariff treatment, creating an uneven competitive landscape that threatens to erode India’s historical market position.

Indian exporters have specifically voiced concerns about potential market share losses to these ASEAN competitors. The 25% price differential created by the tariff is substantial enough to influence purchasing decisions, particularly for large-volume buyers where such margins significantly impact overall procurement costs.

This trade policy development creates several strategic implications for market participants:

These trade dynamics suggest potential volume growth opportunities for Vietnamese and Indonesian operations targeting the U.S. market. Conversely, investments in Indian pepper production would benefit from strategies focused on value-added processing, premium market segments, or export markets without disadvantageous tariff structures.