2025 // Week 33 – Global Pepper Market Analysis : Vietnam, Brazil, Indonesia’s Market Positioning

Vietnam Market Overview: Strategic Inventory Management

Vietnam’s pepper market has displayed interesting dynamics in mid-2025, with domestic purchase prices currently ranging between 141,000 – 145,000 VND/kg. Despite a favorable harvest season, the International Pepper Community (IPC) has documented a notable decrease in Vietnam’s export volumes during the first half of 2025. This apparent contradiction between good production and reduced exports suggests a deliberate strategy by Vietnamese producers and exporters. Industry analysis indicates that Vietnamese stakeholders are intentionally holding back inventories as a buffer against market volatility. This approach represents a shift from previous years when Vietnam typically maximized export volumes immediately after harvest. The significant carry-over stock Vietnam plans to bring into 2026 introduces an important element of supply flexibility in the global pepper market. This reserve capacity could serve as a stabilizing mechanism if:

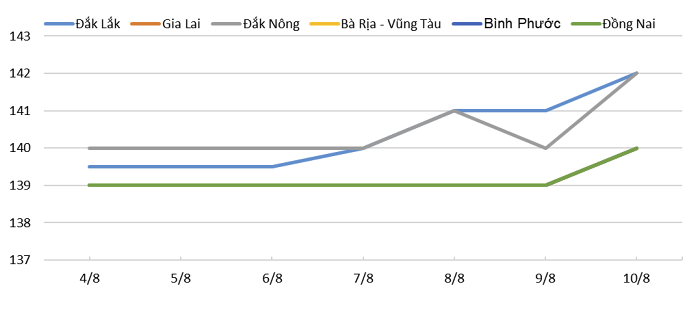

Pepper price developments in the Central Highlands and Southeast regions during the week from August 04 to August 10, 2025

Brazil’s Market Position: Mastering Price Arbitrage

Brazil has emerged as a particularly dynamic player in the global pepper market during the first half of 2025, recording substantial export growth. Unlike Vietnam’s inventory-holding approach, Brazil has adopted a highly responsive trading strategy focused on exploiting price arbitrage opportunities in international markets. This approach reflects Brazil’s increasing sophistication in global commodity trading, with exporters demonstrating remarkable agility in responding to market signals. Brazilian traders have been particularly effective at capitalizing on price differentials during periods when Vietnamese supply has been constrained or delayed.

The effectiveness of Brazil’s arbitrage strategy is underscored by the price stability maintained in June 2025. While Vietnamese export prices experienced a sharp decline, Brazilian prices remained notably stable. This price resilience suggests two critical market insights:

1. Brazil’s available domestic stock has reached extremely low levels, limiting the country’s ability to increase export volumes even if prices were to rise further.

2. Specific demand exists for Brazilian pepper from certain importing markets, likely due to quality characteristics, established trade relationships, or particular contract specifications that Vietnam cannot easily fulfill.

The absence of significant trade flows between Brazil and Vietnam for re-export activities over the past two months further supports the assessment that Brazilian domestic stocks have become highly limited. This trade pattern typically emerges when one country has surplus inventory that another can market more effectively to specific end users. For procurement professionals, Brazil’s current market position necessitates forward-looking strategies, as immediate spot purchases may be increasingly difficult to secure at competitive prices.

With Brazil’s domestic pepper inventories currently at low levels, market attention is increasingly focused on the upcoming harvest season. Production in northern Brazil, which represents a significant portion of the country’s pepper output, is scheduled to begin in September 2025.

Early market activity has already commenced, with initial offers for deliveries between September and December 2025 beginning to circulate among traders and importers. These forward contracts provide an important window into market expectations for both volume and pricing in the latter part of the year.

Indonesia’s Export Performance: Strong First Half

Indonesia has demonstrated remarkable performance in the global pepper market during the first half of 2025, with export volumes increasing by an impressive 30% compared to the same period last year. This substantial growth has cemented Indonesia’s position as a key player in the international pepper trade alongside Vietnam and Brazil. A closer examination of Indonesia’s export pattern reveals several distinctive characteristics:

Similar to Brazil, Indonesia now appears to be operating with limited exportable stocks. However, Indonesia’s situation is further complicated by robust domestic demand. Unlike Vietnam and Brazil, where domestic consumption represents a relatively small percentage of production, Indonesia’s internal pepper consumption continues to grow significantly year over year. For international buyers, Indonesia’s current market position presents both challenges and opportunities. While immediate large-volume spot purchases may be difficult to secure, Indonesia’s different harvest timing compared to Brazil and Vietnam could position it as an important supply source at specific points in the annual cycle.