2025 // Week 35 – Vietnam Pepper Market Analysis: Navigating Tariffs and Supply Trends

Current Price Trends and Market Dynamics

Vietnam’s pepper prices currently range between 148,000 – 151,000 VND/kg, representing a significant weekly increase of 6,000 – 8,000 VND/kg. This upward movement reflects broader market conditions that are creating a favorable environment for producers. Two key factors are driving this price momentum:

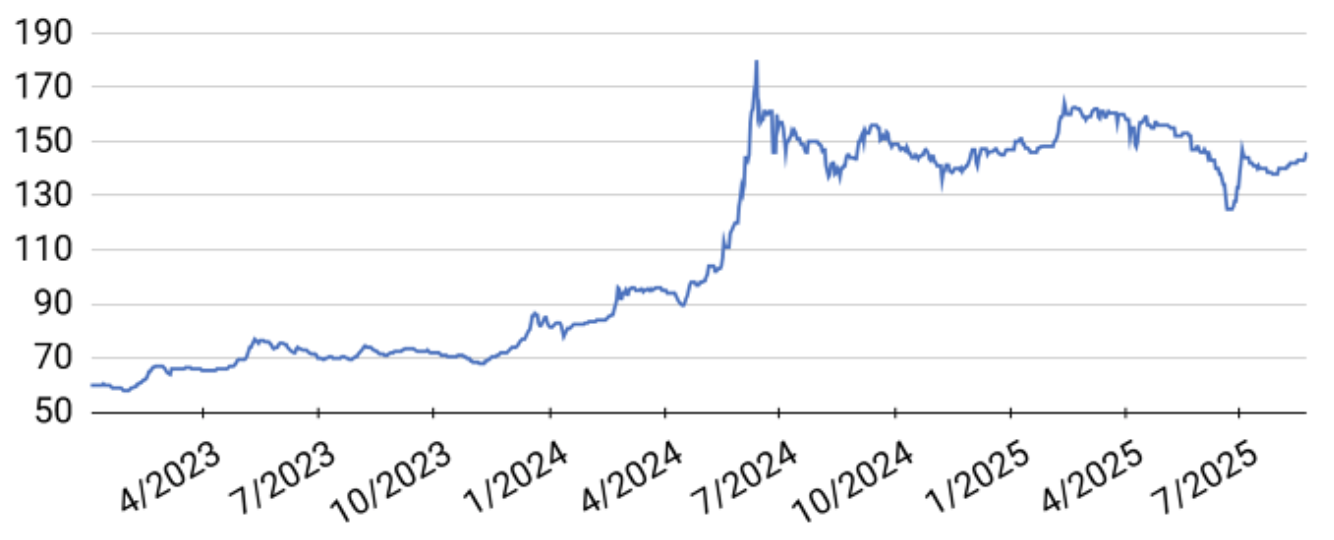

Pepper price developments in the Central Highlands and Southeast from First 2023 to August 25, 2025 (Unit: VND/kg)

Global Demand Patterns and Major Import Markets

Understanding the global demand landscape is crucial for exporters positioning their strategies in the competitive pepper market. The United States maintains its position as the world’s largest pepper consumer market, accounting for 28.9% of global imports at 45,446 tons. However, this represents a significant 18.7% year-over-year decline, indicating potential market saturation or shifting consumption patterns that warrant careful monitoring.

Beyond the dominant US market, four other key import destinations shape global trade flows:

- India: Importing 18,091 tons, India represents a major secondary market with growing domestic consumption

- Germany: At 13,369 tons, Germany serves as both a major consumer and processing hub for European distribution

- France: Importing 6,723 tons, France maintains consistent demand for high-quality pepper varieties

- United Kingdom: With 5,929 tons, the UK market shows resilience despite broader economic challenges

The 18.7% decline in US imports deserves particular attention. This reduction may reflect either inventory adjustments following previous stockpiling, economic pressures affecting food manufacturing, or potentially increased domestic production of substitute products. Exporters should closely monitor whether this represents a temporary fluctuation or the beginning of a longer-term trend.

Supply-Demand Balance and Global Production Outlook

According to comprehensive analysis from a leading Dutch spice company, global pepper production in 2025 is projected to reach approximately 434,000 tons, remaining relatively stable compared to the previous year. This production plateau comes at a critical time when market fundamentals are shifting decisively in favor of producers.

For the fifth consecutive year, global pepper demand has outpaced available supply, systematically drawing down global inventory positions to historically low levels. This persistent structural deficit creates several important market implications:

Inventory Depletion

Global pepper stocks have reached critically low levels after multiple years of net drawdowns, removing the buffer that previously moderated price volatility during supply disruptions.

Price Support

The fundamental supply shortage provides strong underlying support for current price levels, with potential for additional upside if production faces any weather-related or logistical challenges.

*this supply-demand imbalance suggests continued favorable pricing conditions for producers and exporters through at least mid-2026, barring any significant production increases. The sustained deficit also indicates that even modest disruptions to production in any major growing region could trigger outsized price movements due to limited global buffer stocks.

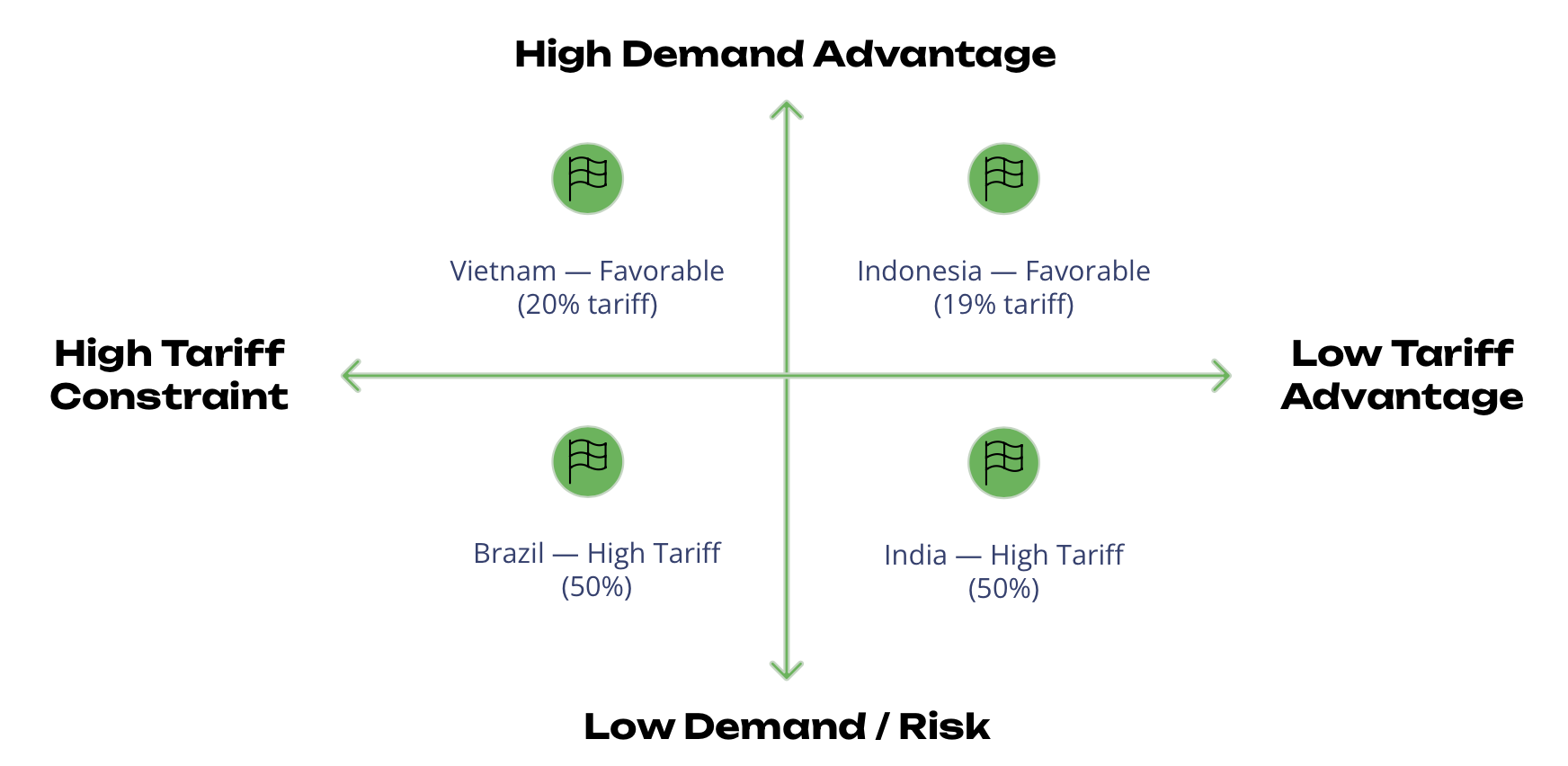

Impact of US Tariff Policy on Global Pepper Trade

The Import-Export Department of Vietnam’s Ministry of Industry & Trade has released analysis highlighting how recent changes in US tariff policy are reshaping competitive dynamics in the global pepper trade. These tariff adjustments create a complex competitive landscape with clear winners and losers among major exporting nations.

The implementation of a substantial 50% import tariff on Brazilian pepper imports to the US market represents a pivotal shift that will significantly reduce Brazil’s competitiveness and market share. This same punitive 50% tariff will also apply to Indian pepper exports, placing both nations at a severe disadvantage in the world’s largest import market.

By contrast, Vietnam’s pepper exports will face a substantially lower tariff rate of 20%, while Indonesian pepper benefits from an even more favorable rate of 19%. This differential tariff treatment creates a clear competitive advantage for Southeast Asian producers in the critical US market. The 30-percentage-point tariff advantage versus Brazil and India effectively offsets historical price premiums that Vietnamese exporters previously needed to overcome.

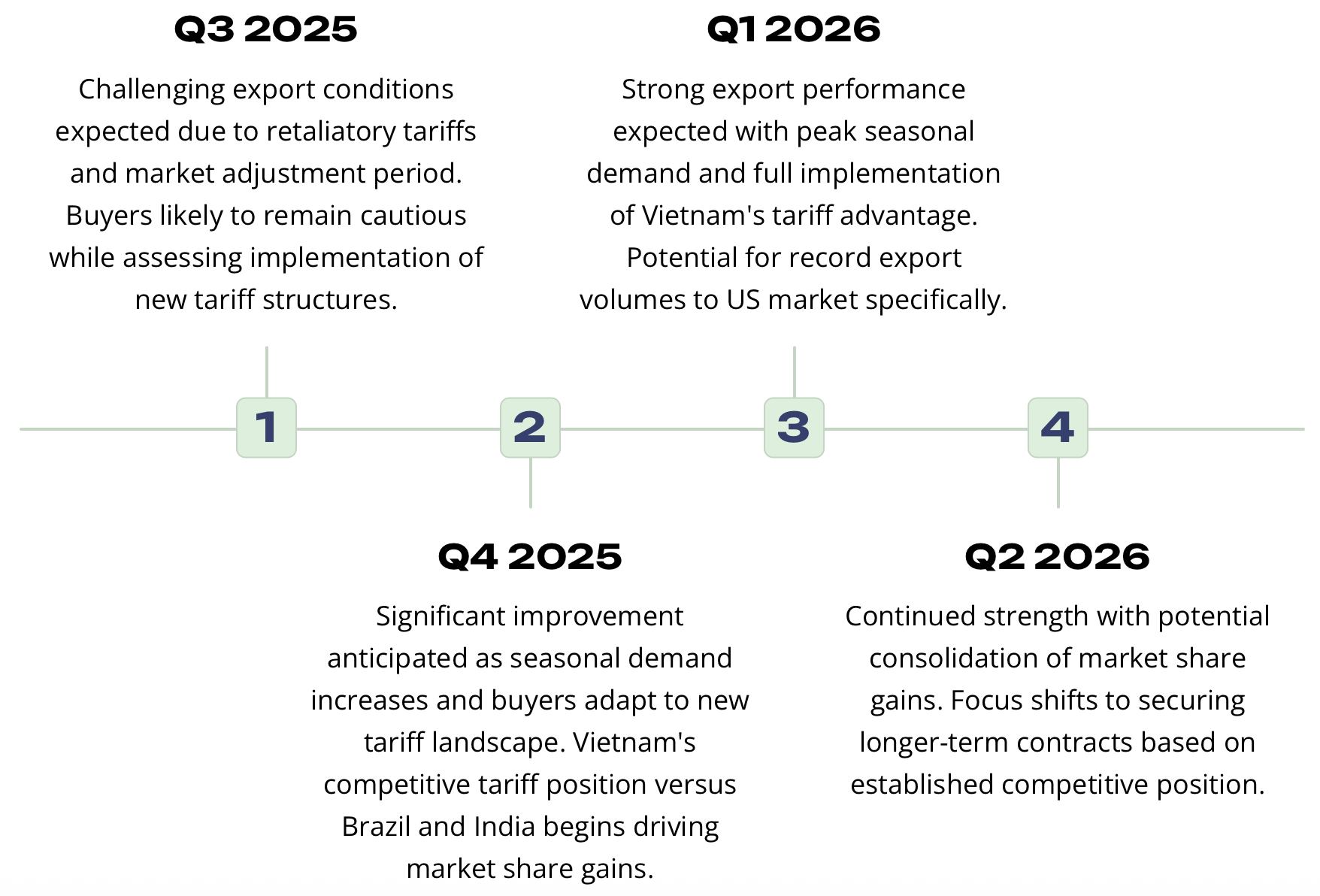

Export Outlook and Quarterly Projections

Vietnam’s pepper export trajectory for the remainder of 2025 and early 2026 appears increasingly favorable despite near-term challenges. The Import-Export Department forecasts that global pepper prices will strengthen considerably in the second half of 2025, creating a positive environment for value maximization.

The market is currently experiencing what analysts characterize as a temporary “pause” phase, driven by two primary factors:

- Complex and evolving tariff policies creating uncertainty among buyers

- Slower buying sentiment as importers assess market direction

The current demand slowdown appears largely tactical rather than fundamental, with major markets—especially the US—expected to significantly increase purchasing activity in Q4 2025 and Q1 2026. This creates a favorable environment for Vietnam’s pepper exporters to capitalize on both higher prices and potential market share gains from higher-tariff competitors.