2025 // Pepper Market & Price Behaviors – August 2025 Recap

Domestic Price

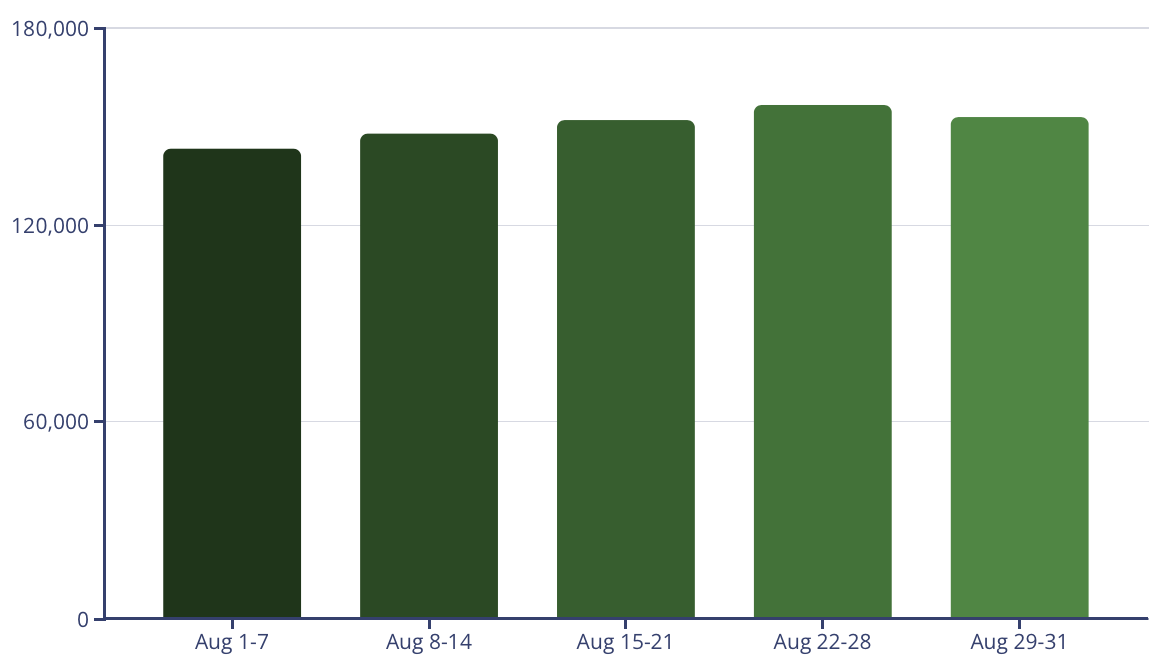

The Vietnamese domestic pepper market demonstrated remarkable strength throughout August 2025, recording substantial gains despite a late-month correction. Opening the month in the 143,000-146,000 VND/kg range, prices exhibited steady upward momentum that accelerated mid-month before reaching a peak of 155,000-158,000 VND/kg on August 27th. This rally represented nearly an 8-9% increase from the month’s starting values, underscoring the robust demand dynamics present in the market.

The final days of August witnessed a moderate correction as prices settled back to the 152,000-154,000 VND/kg range. Despite this late pullback, the market still recorded an impressive monthly gain of 10,000-12,000 VND/kg.

Global Market Landscape & Competitive Positioning

Key Market Drivers & Influencing Factors

Seasonal Demand Patterns

Buyers across major consumption centers in North America, Europe and Asia have begun their typical Q4 procurement cycle in preparation for the festival/holiday consumption peak. This seasonal pattern drives significant volume commitments during August-September, with processors and distributors building inventory to ensure supply chain continuity through year-end demand surges.

Currency Effects

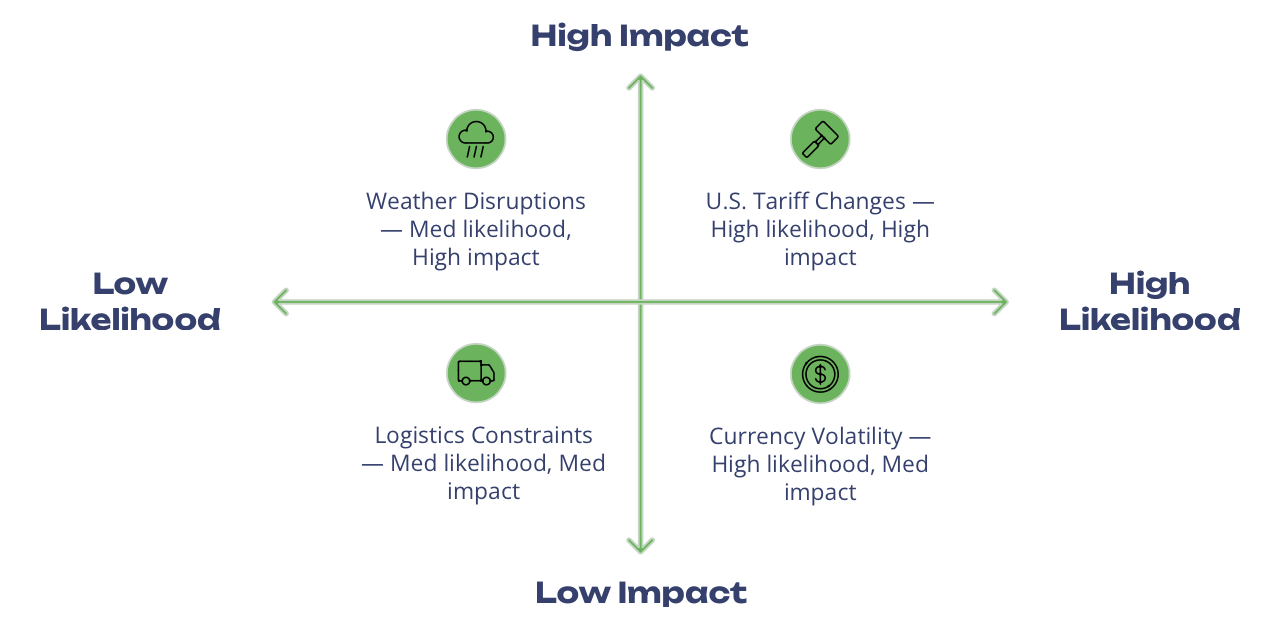

The U.S. dollar showed notable weakness mid-August following Federal Reserve signals regarding potential rate cuts. This currency movement provided broad support for dollar-denominated commodities, including pepper.

Tariff Dynamics

The differential tariff structure imposed by the United States continues to reshape trade flows. The 50% tariff on Brazil and India versus 20% for Vietnam and 19% for Indonesia has created significant competitive advantages. A late August court ruling challenging the constitutional basis of these tariffs introduced new uncertainty, triggering some speculative unwinding that contributed to the month-end correction.

Supply Constraints

Vietnam’s 2025 harvest totaling approximately 172,000 tons represents a significant decline from the previous year’s 190,000 tons. This production shortfall, combined with the fact that many small farmers have already liquidated their inventories, has created intense competition among exporters for remaining stocks. The reduced flow of Brazilian pepper into Vietnam (from 3-4,000 tons monthly to around 1,000 tons) has further exacerbated this supply tightness.

Behavioral Market Dynamics & Participant Strategies

The pepper market’s price behavior in August revealed distinct strategic approaches among the three primary participant groups: farmers, exporters, and speculators. These behavioral patterns provide valuable insight into market psychology and likely future price dynamics.

Farmer Behavior

A clear bifurcation emerged between smallholders and larger growers. Smallholders, typically with less than 2 hectares and limited storage capacity, have largely sold their production earlier in the season. In contrast, financially stronger farmers with larger holdings continue to maintain substantial inventories, creating a solid price floor in the domestic market.

Exporter Strategies

Exporters faced intensifying margin pressure as they were forced to compete for limited domestic stocks at steadily rising prices. The reduced flow of Brazilian pepper imports (from 3-4,000 tons monthly to approximately 1,000 tons) eliminated a key alternative supply source that had previously provided pricing leverage.

Speculator Positioning

Speculative capital showed active participation throughout the month, adding to positions during the mid-month rally. However, the late August U.S. court ruling challenging tariff authorities triggered a notable reduction in speculative length, contributing significantly to the three-day correction that closed the month.

Market Outlook & Strategic Recommendations

Short Term

Substantial volatility around U.S. Supreme Court tariff hearing. Price swings of 5-8% possible. Strategy: Implement strategic hedging; consider options to protect against adverse moves.

Medium Term

Traditional year-end demand surge from U.S. and EU buyers will likely lift prices. Bullish bias due to declining global production and resilient demand. Strategy: Build long positions on any October weakness; consider direct contracting.

Structural Trend

The fundamental backdrop for the global pepper market remains constructive, with 2025 marking the fourth consecutive year of declining global production while demand continues to demonstrate resilience. This production shortfall, combined with the differential tariff structure currently favoring Vietnamese origins in the critical U.S. market, creates a compelling case for sustained price support.