2025 // Week 43 – Vietnam’s Pepper Crossroads: Navigating Demand, Dynamics, and Dominance

Current Market Dynamics and Price Trends

Domestic pepper prices currently range between 145,000 – 148,000 VND/kg, reflecting recent market adjustments driven by multiple factors. By the end of last week, prices across major producing regions experienced a notable decline, losing 1,000 – 3,000 VND/kg on average. This downward pressure stems primarily from capital diversion to the ongoing coffee harvest season, as farmers and traders reallocate resources to what is perceived as a more immediate opportunity.

Pepper price developments in the Central Highlands and Southeast from First 2023 to Oct 20, 2025 (Unit: VND/kg)

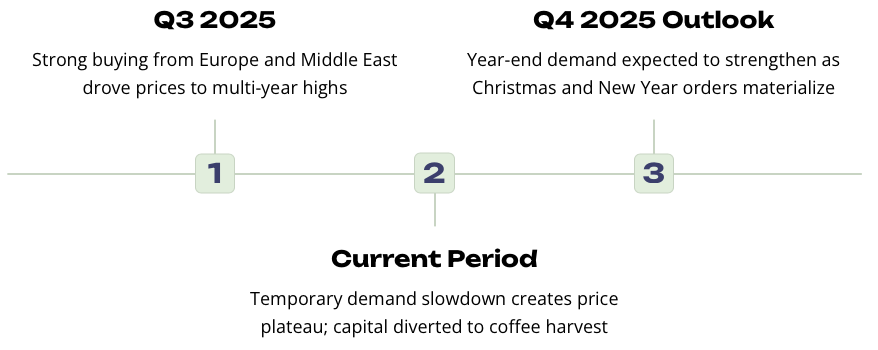

Import demand has remained subdued in recent weeks, creating headwinds that have effectively restrained the upward momentum pepper prices experienced earlier in the year. The convergence of domestic capital shifts and weakened international buying interest has created a stabilization phase in the market, with traders adopting a wait-and-see approach before committing to large-volume transactions.

On the international front, Vietnam’s benchmark 500 g/l black pepper grade has maintained stable pricing without major fluctuations, demonstrating resilience despite the temporary softening in demand. This stability reflects the fundamental strength of Vietnamese pepper’s quality reputation and the country’s dominant market position in global spice trade networks.

Export Performance and Market Share Shifts

Vietnam’s pepper export performance during the first nine months of 2025 has been nothing short of remarkable, with total export value nearly matching the entire year 2024 figures. This accelerated pace underscores the robust demand that characterized much of the year, particularly during the strong Q3 buying period from European and Middle Eastern markets.

The shift away from U.S. market concentration toward a more diversified export base represents a strategic evolution for Vietnamese pepper trade. While the decline in U.S. share from 28.9% to 22.4% is substantial, the compensating growth in Germany, India, and several emerging Asian and Middle Eastern markets demonstrates the adaptability of Vietnam’s export infrastructure and the global appeal of its pepper products.

The U.S. government’s current consideration of tariff exemptions for hundreds of imported goods that America does not produce domestically presents a potentially positive development for Vietnamese pepper exporters. Since the United States lacks domestic pepper production capacity, Vietnamese suppliers could benefit from more favorable trade terms, potentially reversing some of the recent market share erosion if exemptions are implemented.

Trade and Policy Factors

Industry experts and market analysts have observed that Vietnam’s export prices have reached a plateau phase following the robust demand witnessed during Q3 2025. The temporary slowdown in import demand from Europe and the Middle East, which were aggressive buyers throughout the third quarter, has contributed to this stabilization. However, it’s crucial to contextualize this plateau within the broader historical price framework.

Despite the recent softening, current prices remain among the highest recorded in recent years, confirming Vietnam’s competitive market position and the sustained value of its pepper products. This pricing power reflects both quality differentiation and supply-demand fundamentals that continue to favor Vietnamese exporters over the medium term.

Price Forecast and Strategic Outlook

Short-Term Forecast (Starting October 21)

Analysts forecast that pepper prices will likely stabilize or experience slight declines in the upcoming week, with the expected range falling between 143,000 – 147,000 VND/kg. This represents a potential downward adjustment of 1,000 – 2,000 VND/kg from current levels. A strong short-term rebound appears unlikely unless significant new developments emerge in export markets or exchange rate movements create arbitrage opportunities that incentivize aggressive buying.

Medium-Term Outlook (Q4 2025)

Looking toward the fourth quarter of 2025, experts maintain a decidedly positive outlook based on favorable supply-demand fundamentals. Domestic inventories remain at low levels following the strong export performance in the first nine months of the year, creating a supply constraint that should provide price support as demand increases.

Year-end demand from importing countries is expected to strengthen as the holiday season approaches and food service, retail, and industrial buyers secure inventory for peak consumption periods. If Christmas and New Year orders are confirmed early—typically in late October through early November—prices could recover upward momentum again during the November-December timeframe, potentially reaching or exceeding the 150,000 VND/kg threshold.