2025 // Week 44 – Vietnam Pepper Market Analysis: Navigating Stability and Strategic Growth

Current Market Dynamics and Price Movements

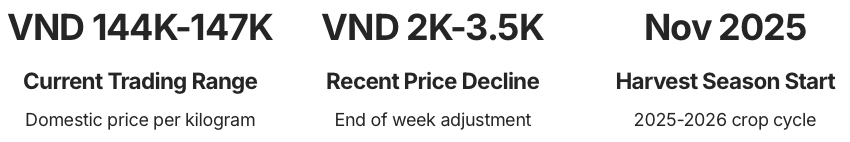

The domestic pepper market has entered a period of consolidation following recent price adjustments. Trading ranges between VND 144,000 and VND 147,000 per kilogram reflect a market seeking equilibrium as stakeholders anticipate the incoming harvest. The modest price decline witnessed at the end of last week represents a natural market correction rather than a fundamental weakness.

Pepper price developments in the Central Highlands and Southeast from First 2023 to Oct 27, 2025 (Unit: VND/kg)

Central Highlands farmers are currently in the critical final care stage of crop development, implementing precise agricultural practices to optimize yield quality ahead of the November harvest launch. Industry experts project a manageable price softening of VND 1,000-2,000 per kilogram once new supply enters circulation, with the overall price trend remaining constructive for producers and exporters alike.

The international landscape presents an interesting divergence, with India standing as the sole producing country recording price increases during the previous week. This differential pricing environment creates strategic arbitrage opportunities for Vietnamese exporters to capture market share in price-sensitive segments while maintaining premium positioning in quality-focused markets.

Global Market Supporting Price Recovery

Fed Interest Rate Policy

Positive U.S. inflation data creates favorable conditions for the Federal Reserve to implement interest rate cuts this week. Lower rates typically weaken the USD, making dollar-denominated commodities more attractive to international buyers and supporting price appreciation across agricultural markets including pepper.

U.S.-China Trade Framework

The October 26 preliminary trade agreement between the world’s two largest economies marks a significant de-escalation of trade tensions. This diplomatic breakthrough has triggered capital reallocation as speculators rotate funds from safe-haven assets like gold into commodity markets, increasing liquidity and price support for agricultural products.

Commodity Market Sentiment

The convergence of accommodative monetary policy and improved trade relations creates a bullish backdrop for commodity investments. Pepper, as a key spice commodity, benefits from this positive sentiment shift, with improved demand expectations and stronger purchasing power in emerging markets driving incremental consumption growth.

Vietnam Export Performance

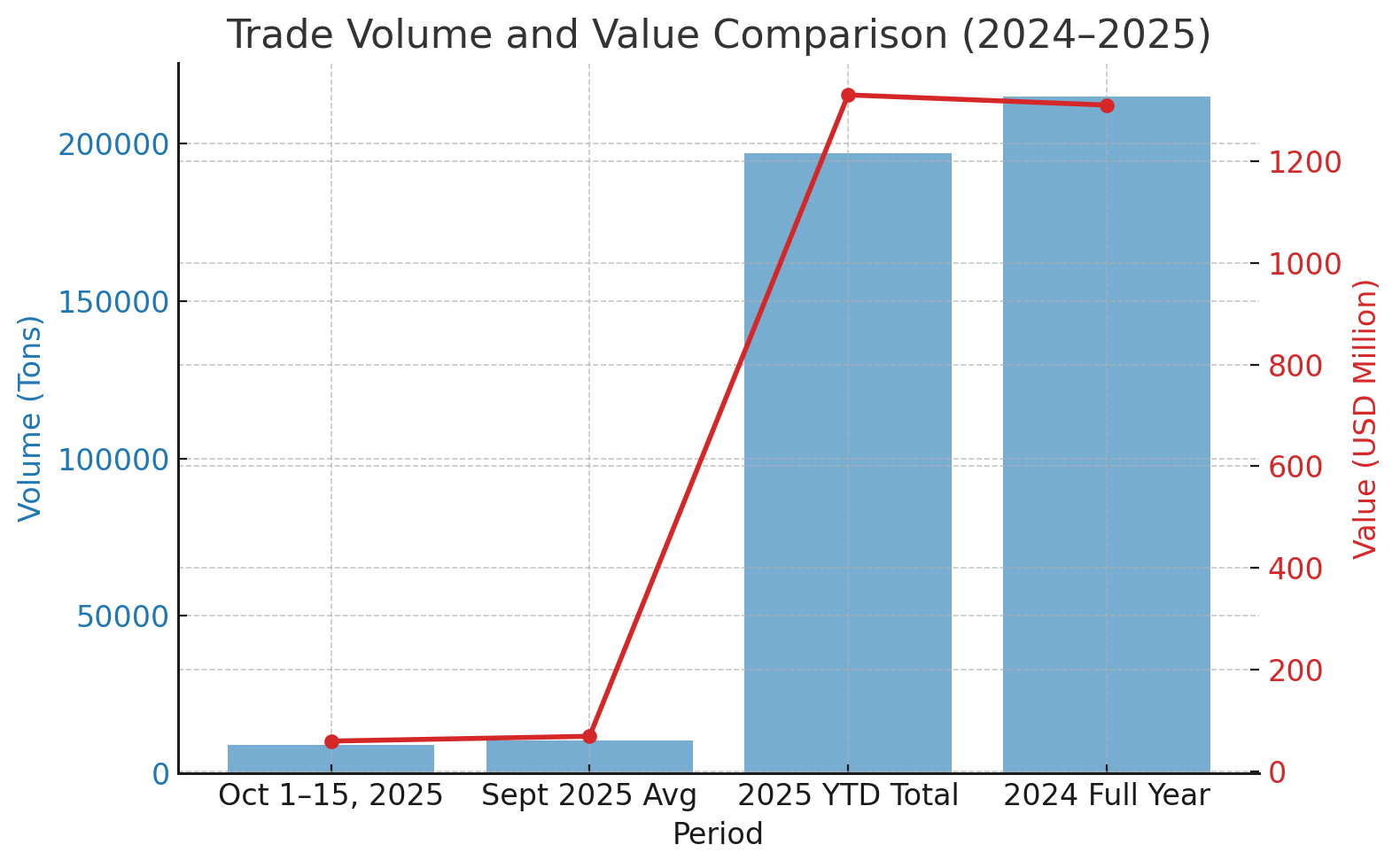

Vietnam’s pepper export performance during the first half of October reveals important market dynamics. The country shipped 9,056 tons valued at USD 59.9 million, representing a 14.1% volume decline and 13.6% value reduction compared to September’s average performance. However, context is critical when interpreting these figures.

Year-to-date cumulative exports through October 15 reached 197,100 tons generating USD 1.33 billion in revenue, already surpassing the entire 2024 annual export value of USD 1.31 billion. This remarkable achievement demonstrates Vietnam’s strengthened market position and improved pricing power, even as total volume remains below the previous year’s pace.

The “lower volume, higher value” profile signals a strategic evolution in Vietnam’s pepper trade. Rather than competing solely on volume, Vietnamese exporters are capturing enhanced margins through quality differentiation, processing sophistication, and brand development. This transition supports more sustainable industry economics and positions Vietnam as a premium supplier rather than a commodity provider in global markets.

Market Outlook and Strategic Recommendations

The incoming harvest season will test market absorption capacity, with experts anticipating modest price pressure of VND 1,000-2,000 per kilogram as fresh supply enters circulation. However, supportive macroeconomic conditions and strong year-to-date export value provide a cushion against significant price deterioration.

The Federal Reserve’s anticipated rate cuts and improved U.S.-China trade relations create favorable conditions for commodity price stability. Currency dynamics favoring emerging market exporters should support demand from major importing nations, particularly in Europe and North America where pepper consumption remains robust.

Vietnam’s pepper industry stands at a pivotal moment. The convergence of favorable macroeconomic trends, successful strategic transformation toward value-added production, and maintained global market leadership creates an exceptionally strong foundation for sustained growth. Industry stakeholders who embrace quality enhancement, processing sophistication, and market diversification will capture disproportionate benefits as global pepper demand continues expanding. The path forward requires continued investment in agricultural technology, processing infrastructure, and market development to cement Vietnam’s position as the world’s premier pepper supplier for decades to come.