2025 // Week 45 – Vietnam Pepper Market: Stability Amid Global Industry Momentum

Vietnam Pepper Market and International Community Meeting in Kochi

Pepper price developments in the Central Highlands and Southeast from First 2023 to Nov 03, 2025 (Unit: VND/kg)

Expert speakers at the conference have issued a compelling call to action: the pepper industry must unite to expand black pepper cultivation globally. This collaborative approach aims to address supply constraints, stabilize pricing volatility, and unlock new consumption opportunities across emerging markets. The focus extends beyond mere production increases to encompass sustainable farming practices, quality improvement initiatives, and market development strategies that benefit producers and consumers alike.

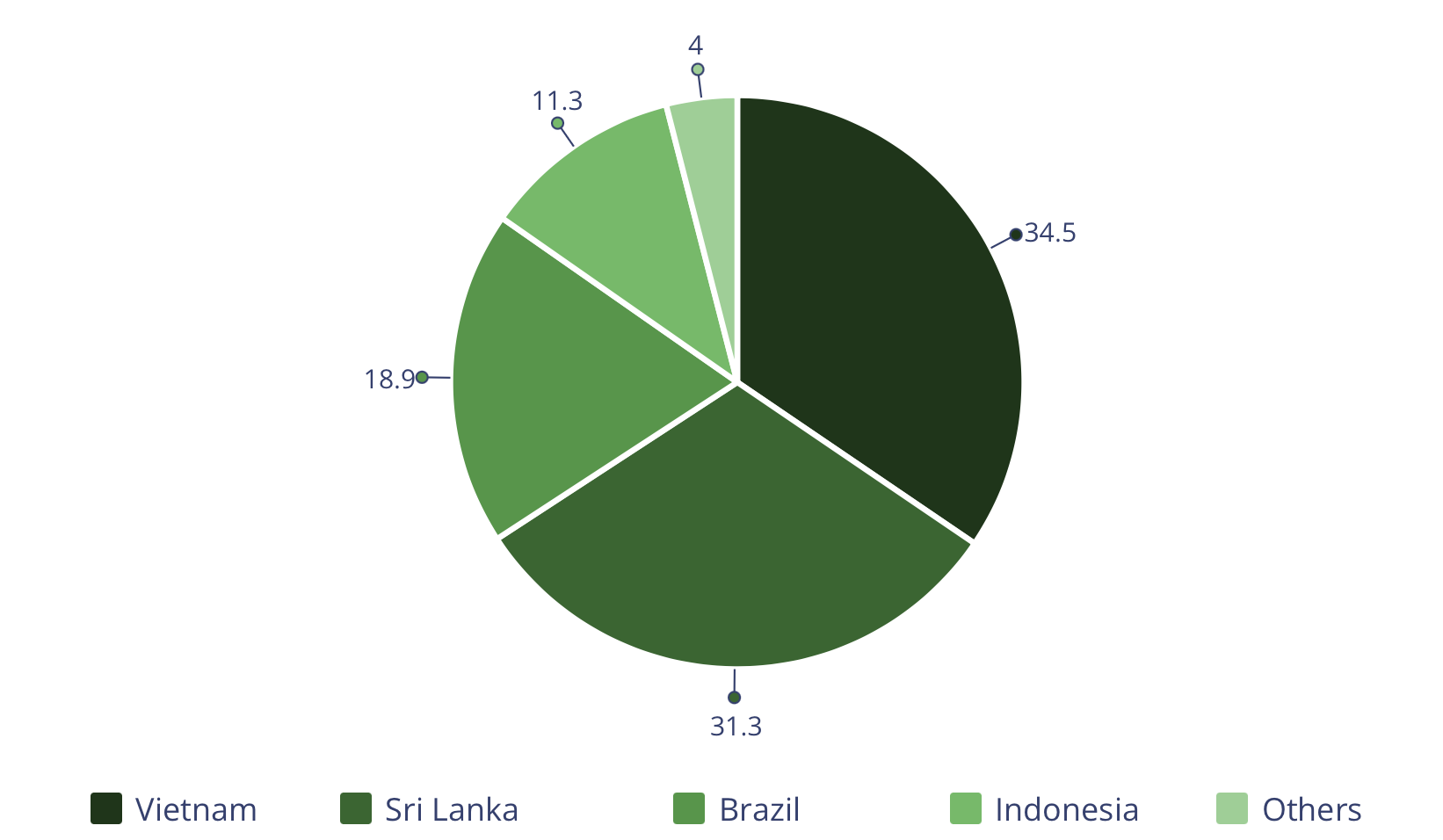

India’s Pepper Imports: Vietnam Market Share Analysis

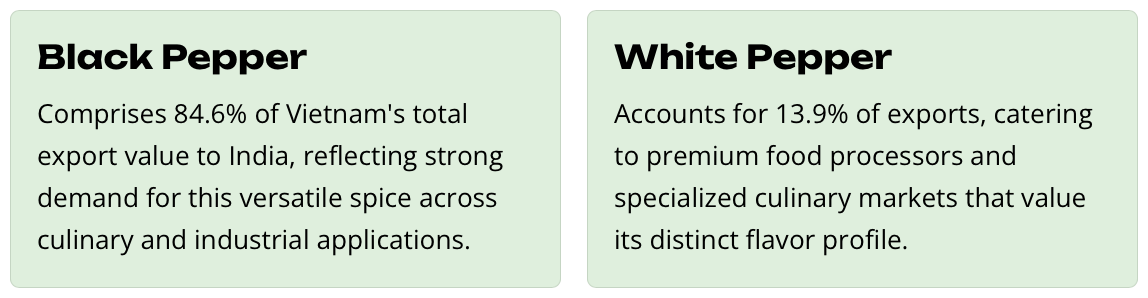

Vietnam has solidified its position as India’s premier pepper supplier, accounting for 34.5% of total imports in the first eight months of 2025. This translates to 9,563 tons shipped to Indian markets, representing a healthy 7.1% year-over-year increase. The country’s competitive pricing, consistent quality standards, and established trade relationships continue to give Vietnamese exporters a decisive edge in this rapidly growing market.

While Vietnam leads, competition remains robust. Sri Lanka holds 31.3% market share despite a significant 39.3% decline, while Brazil and Indonesia are gaining ground with 18.9% and 11.3% respectively. Indonesia’s impressive 54.8% growth demonstrates the dynamic nature of the market, though Vietnam’s established infrastructure and quality reputation maintain its leadership position in this competitive environment.

India’s total pepper imports for January-August 2025 reached 27,682 tons, representing a 10.5% decrease compared to the previous year, yet still marking a substantial 34.4% increase over 2023 levels. This volatility reflects both market maturation and evolving demand patterns. August 2025 saw imports dip to 2,541 tons, down 28.6% month-over-month, suggesting seasonal fluctuations and inventory management strategies among Indian importers.

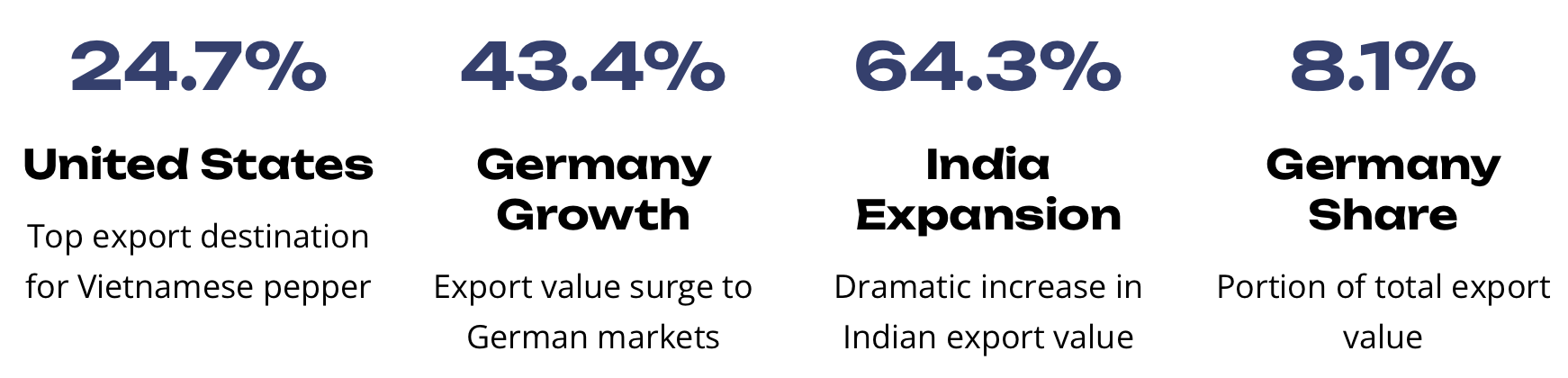

Vietnam’s Global Export Highlights

Vietnamese pepper exporters have successfully diversified their market portfolio across the first three quarters of 2025. The United States remains the dominant destination, absorbing nearly one-quarter of all export value. However, the most exciting developments are emerging in European and Asian markets, particularly Germany and India, which have demonstrated exceptional growth rates that significantly outpace traditional markets.

Germany’s 43.4% surge in import value reflects growing European demand for premium spices in processed foods, restaurant chains, and specialty retail. Meanwhile, India’s extraordinary 64.3% jump signals a fundamental shift in regional trade patterns. As India’s domestic production faces weather-related challenges and declining output, Vietnamese suppliers are perfectly positioned to fill the supply gap with competitive pricing and reliable delivery schedules.

Market Outlook: Opportunities Amid Supply Challenges

The convergence of several powerful market forces creates an exceptionally favorable environment for Vietnamese pepper exporters. India’s demographic trends continue to support consumption growth, with a population exceeding 1.4 billion people and a rapidly expanding middle class seeking diverse culinary experiences. Rising disposable incomes translate directly into increased spending on food, spices, and restaurant dining, creating sustained demand for premium pepper products. With India’s production challenges and growing demand, Vietnamese exporters should prepare for volume increases and potential price optimization.