2025 // Week 46 – Global Pepper Market Outlook: Stability Amid Supply Constraints

Domestic Market: Dynamics and Supply Constraints

Pepper price developments in the Central Highlands and Southeast from First 2023 to Nov 10, 2025 (Unit: VND/kg)

Pepper price developments in the Central Highlands and Southeast from First 2023 to Nov 10, 2025 (Unit: VND/kg)

Domestic pepper prices remain stable, trading consistently in the ₫145,000 – ₫147,000/kg range. This steadiness reflects a closely balanced market where supply tightness from farmers aligns with sustained international demand. The near-complete depletion of old-crop stocks represents a critical juncture in the seasonal cycle, compelling stakeholders to carefully manage inventory levels.

Processing enterprises have identified current price levels as sufficiently attractive to stimulate farmer investment in garden maintenance and preparation for the upcoming harvest season. This positive sentiment supports confidence in continued market engagement and suggests farmers view the current environment as conducive to production expansion.

Market experts project that pepper prices will likely maintain elevated levels through the conclusion of 2025, particularly as demand accelerates during the year-end consumption and import peak season. This seasonal pattern has historically driven price stability, provided that production capacity from Vietnam and Indonesia does not experience significant expansion. The fundamental supply-demand balance suggests prices may either remain elevated or experience modest increases during these final weeks of 2025.

Global Production Overview: Brazil, Vietnam, and Indonesia

Brazilian Market Dynamics

Brazil’s new pepper harvest is expected to commence at the end of November, with primary production concentrated in the southern regions of Espirito Santo and Bahia, with activity extending into early 2026. Northern Para harvesting has already concluded. Production forecasts indicate yields will be slightly higher than the previous year, demonstrating continued productivity in Brazilian pepper cultivation. However, a critical market factor is the limited selling pressure despite these healthy yields. Farmers and traders maintain strong financial positions, enabling them to hold stockpiles rather than immediately liquidate inventory. This strategic retention approach significantly influences global price dynamics.

Key Export Metrics

- Brazil exported ~64,000 tons by September 2025

- Surpasses volumes from previous years

- U.S. tariffs show minimal impact to date

- Strong financial positions enable farmer stock retention

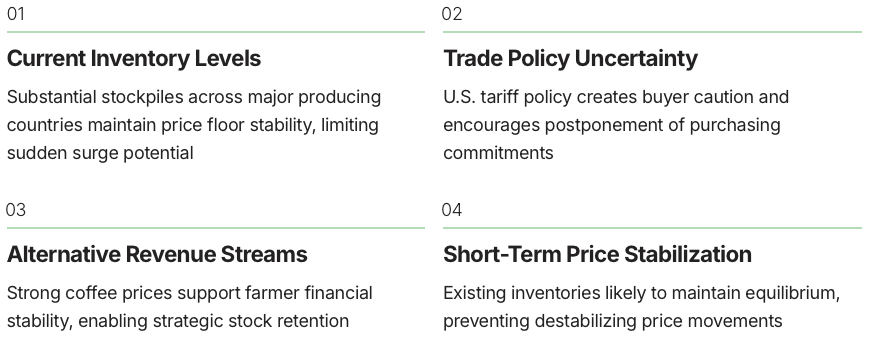

Stockpiles persist across Vietnam, Brazil, and Indonesia, yet selling pressure remains constrained. Strong international coffee prices have provided farmers with alternative revenue streams, reducing their urgency to liquidate pepper stocks. Simultaneously, recent U.S. tariff policy shifts have created cautious market sentiment, with buyers adopting wait-and-see attitudes rather than committing to large purchases. This combination of factors creates a market environment characterized by price stability and limited volatility.

Trade & Policy Factors: Tariffs, Inventory, and Price Projections

Scenario Analysis and Price Outlook

Market forecasts indicate two primary scenarios that will shape pepper prices through year-end 2025 and into early 2026. First, potential U.S. import tariff reductions could catalyze renewed buying interest, stimulating demand and potentially supporting higher price levels. Conversely, unexpected supply constraints originating from Vietnam or India could trigger price increases if production disruptions occur. The most probable scenario involves continuation of the current price stability trajectory, with existing inventories maintaining adequate supply to prevent price spikes. However, the confluence of seasonal demand increases and geopolitical trade policy uncertainties suggests that market participants should remain vigilant for potential volatility triggers. The delicate balance between adequate inventory levels and persistent demand creates an environment where prices remain elevated but not volatile—a outcome that benefits traders managing inventory costs while supporting farmer revenues.

Market Summary & Outlook

The pepper market currently exhibits structural stability characterized by balanced supply-demand dynamics, supported by existing stockpiles and strong farmer financial positions. Elevated price levels reflect genuine supply tightness rather than speculative excess, suggesting prices possess solid fundamental support. Through the remainder of 2025, expect prices to remain in elevated ranges with limited downside risk but also constrained upside potential unless tariff policy dramatically shifts favorably or unexpected supply constraints emerge from major producing regions. Traders and exporters should prioritize monitoring policy developments while capitalizing on the current stable environment to strengthen operational positions and build relationships with reliable international partners. The market’s fundamental outlook remains constructive for well-positioned participants who maintain strategic flexibility and respond proactively to emerging opportunities and threats.