2025 // Week 47 – Vietnam’s Pepper Export Market: Navigating Growth and Challenges

Domestic Market : Price Stability Amidst Fluctuation

Despite minor weekly declines, the overall stability in domestic prices underscores a robust demand for Vietnamese pepper. The market is continuously adapting to global trade policies, with the recent U.S. tariff exemption acting as a double-edged sword, offering immediate relief but also triggering short-term price adjustments. This exemption is a critical development, influencing both immediate trading strategies and long-term market positioning for Vietnamese exporters.

Pepper price developments in the Central Highlands and Southeast from First 2023 to Nov 17, 2025 (Unit: VND/kg)

Global Market & Outlook: Production Challenges and Recovery Prospects

The Ministry of Industry and Trade’s Import–Export Department has indicated potential challenges for global pepper production in 2025. Unfavorable weather conditions in several key growing regions worldwide are expected to lead to a slight decline in overall production compared to the previous year. This forecast suggests a tighter supply in the near term, potentially contributing to continued high prices.

“Damage from storms during the critical development phase has raised concerns regarding next season’s yields, especially in the Central Highlands and Southeast regions of Vietnam.”

The upcoming harvest, set to begin shortly after the Lunar New Year, faces considerable uncertainty. Recent storms have severely impacted pepper crops during their critical development stage, particularly in Vietnam’s vital Central Highlands and Southeast regions. This damage could significantly affect next season’s yields, posing a direct threat to production volumes.

Despite these immediate concerns, the long-term outlook for global pepper supply remains cautiously optimistic. The global supply chain is anticipated to maintain adequate levels, with worldwide production projected to recover to approximately 533,000 tons in 2026. This recovery hinges on several factors, including the return of favorable weather conditions and the continued implementation of replanting programs in affected areas. Strategic investments in resilient farming practices will be crucial for sustainable growth.

Strategic Advantages: U.S. Tariff Exemption and Market Re-entry

The recent exemption of spices, including pepper, from retaliatory tariffs by the U.S. government marks a pivotal development for the global spice trade. This policy shift has already led to a mild downward pressure on prices as the initial supply tightness eased and market speculators responded by releasing their inventory. However, experts widely regard this as a highly positive step, particularly for exporting nations.

This strategic advantage positions Vietnam to enhance its presence in the U.S. market, provided that its producers and exporters can consistently adhere to the rigorous international standards required for high-value agricultural products. It encourages a focus on quality and sustainable practices to leverage the tariff-free access.

Soaring Vietnam Exports: A Record-Breaking Year

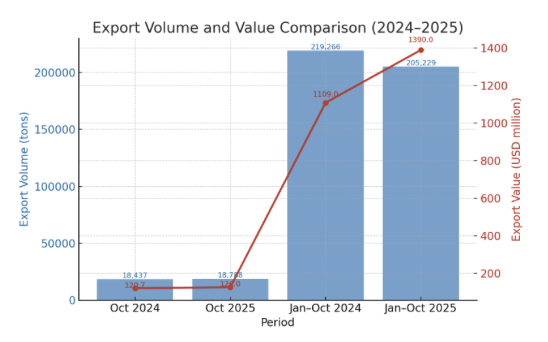

The first 10 months of 2025 have been exceptional for Vietnam’s agricultural sector. According to the Ministry of Agriculture and Environment, key export commodities such as coffee, pepper, and fruits & vegetables have all achieved record-high export values. This remarkable performance positions Vietnam favorably to meet its ambitious export targets.

The International Pepper Community (IPC) has reinforced this positive outlook, forecasting a continued upward trend in global pepper prices. This projection significantly bolsters Vietnam’s goal of achieving USD 1.5 billion in pepper export value for the current year. The combination of strong domestic production and favorable international market conditions creates a fertile ground for sustained growth.

Customs data for October 2025 reveals compelling statistics: Vietnam exported 18,788 tons of pepper, valued at nearly USD 126 million. This represents a 1.9% increase in volume and a 4.42% rise in value compared to October 2024. Cumulatively, for the first 10 months of 2025, exports reached 205,229 tons worth USD 1.39 billion. Although volume saw a 6.4% decrease year-on-year, the value surged by an impressive 25.3%, highlighting the impact of higher prices and strategic market positioning.