2025 // Week 50 – Vietnam’s Pepper Market: Navigating Global Market Dynamics

Domestic Price Volatility and Market Expectations

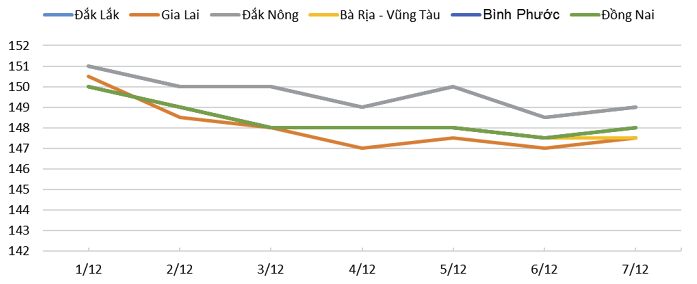

Pepper price developments in the Central Highlands and Southeast regions during the week from December 01 to December 07, 2025 *Source: VPSA

Domestic pepper prices in Vietnam experienced a slight decline this morning, ranging between 149,000 – 151,000 VND/kg, marking a shift after a brief period of increase. This correction follows a strong upward trend that has characterized the market recently. Despite this recent dip, the overall sentiment remains optimistic, largely due to ongoing concerns about tightening global supply and historically low inventory levels.

The market’s resilience against sharper declines, unlike other agricultural commodities, underscores the unique position of pepper as “black gold.” Growers are strategically holding back their stock, anticipating more favorable price signals before re-entering the selling market. Prices below 148,000 VND/kg are currently deemed unattractive, creating a delicate balance between buyer interest and the actual availability of supply. This standoff suggests that significant price movements will likely depend on future supply shocks or a substantial shift in demand dynamics.

Export Performance and Prices (November 2025)

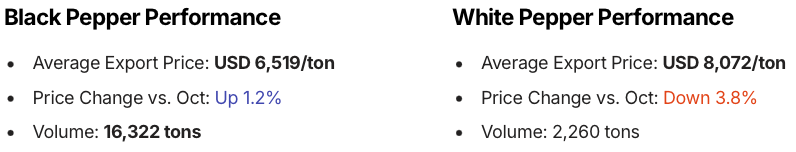

In November 2025, Vietnam exported a total of 18,582 tons of pepper, comprising various types. The average export price for black pepper stood at USD 6,519 per ton, reflecting a modest increase of 1.2% compared to the previous month. In contrast, white pepper commanded an average export price of USD 8,072 per ton, despite experiencing a 3.8% decline from October’s figures. These variations highlight the distinct market dynamics for different pepper varieties.

The overall export performance for November showcased a complex picture. According to the Vietnam Pepper & Spice Association (VPSA), total export volume reached 18,582 tons (16,322 tons black pepper; 2,260 tons white pepper), generating a total value of USD 121.5 million. While this represented a 4.4% decrease in volume and a 6.2% decrease in value compared to October, it marked a significant 16.5% increase in volume and a 14.2% increase in value when compared to November 2024. This year-over-year growth underscores the industry’s robust long-term trajectory despite monthly fluctuations.

Top Export Markets and Volume Distribution

The United States continued to be Vietnam’s largest export market in November 2025, importing 4,587 tons of pepper, representing a 7.1% increase and securing a dominant 24.7% market share. This strong performance highlights the sustained demand from North America. The United Arab Emirates also showed significant growth, importing 2,626 tons, an increase of 6.9%, reinforcing its role as a crucial hub for re-export and regional distribution.

Other notable markets included China, which imported 1,177 tons, despite a slight decrease of 3%. Germany saw a healthy increase of 21.7% with 678 tons imported, indicating growing demand within the European Union. Thailand, however, experienced a decline of 14.9%, importing 657 tons. The varied performance across these key markets underscores the complex global trade landscape and the need for diversified export strategies.

Import Trends and Sourcing Nations

In November 2025, Vietnam’s pepper imports saw a notable increase, reaching a total of 2,459 tons with an estimated value of USD 15.2 million. This volume represents a significant 47.2% surge compared to October, indicating a growing need for supplementary supply within the domestic market or for processing and re-export. However, when compared year-over-year, imports in November 2025 were down by a substantial 43.9% against November 2024, suggesting a fluctuating import strategy possibly influenced by local harvest projections and global supply availability.

The primary supplier of pepper to Vietnam in November was Cambodia, contributing 1,506 tons, which accounted for a dominant 61.2% of total imports. This strong reliance on Cambodia highlights regional trade ties and supply chain efficiencies. Other significant sourcing nations included Brazil, with 475 tons, and Indonesia, providing 210 tons. The diversification of import sources underscores Vietnam’s strategy to secure raw materials from various regions to meet its industrial demand and maintain its position as a leading pepper exporter.

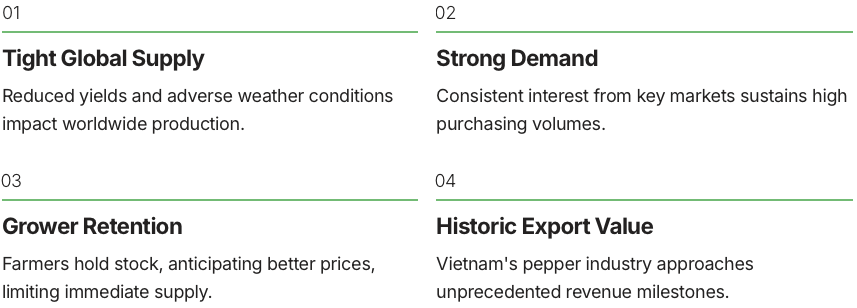

Vietnam’s “Black Gold” Nears Historic Export Value

Vietnam’s pepper industry is on the verge of achieving its highest export value in history. This remarkable performance is primarily fueled by a combination of tightening global supply and consistent demand from major international markets. The strategic withholding of stock by growers, who are awaiting more lucrative selling opportunities, has further contributed to the price appreciation, solidifying pepper’s esteemed status as “black gold” in the agricultural trade.

This strong market position reflects a mature industry capable of leveraging global supply-demand imbalances. The ongoing scarcity of pepper in international markets, coupled with Vietnam’s robust production capabilities and a disciplined approach from its growers, creates an environment ripe for sustained high prices. This trend is a testament to the strategic importance of pepper within Vietnam’s agricultural export portfolio and its significant contribution to the national economy.