2025 // Week 51 – Vietnam’s Pepper Market: A Resurgent Giant

Market Dynamics: Price Surge and Supporting Factors

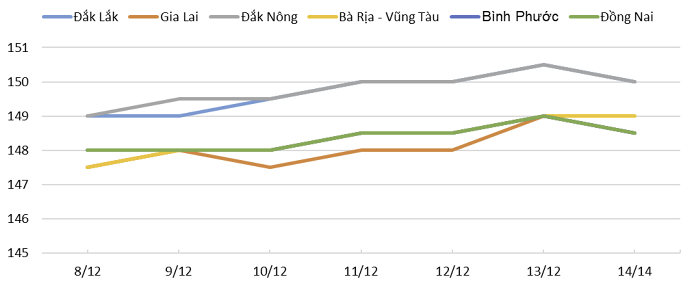

Pepper price developments in the Central Highlands and Southeast regions during the week from December 08 to December 14, 2025 *Source: VPSA

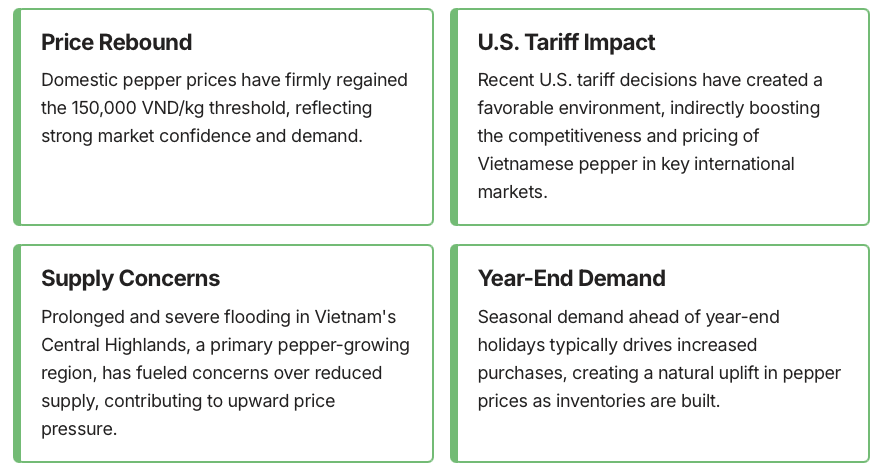

Over the past week, domestic pepper prices in Vietnam have seen a significant surge, ranging between 148,000 – 150,000 VND/kg, firmly reclaiming the 150,000 VND/kg threshold. This positive trajectory is attributed to a confluence of factors. Experts point to the strategic impact of U.S. tariff decisions, which have inadvertently shifted market dynamics in favor of Vietnamese exports. Additionally, severe and prolonged flooding in the crucial Central Highlands growing regions has raised significant concerns about future supply, prompting buyers to secure inventory and driving up prices. The inherent seasonal demand as year-end holidays approach also plays a pivotal role, with a natural increase in purchasing activity further bolstering the market. These elements combined have created a robust environment for pepper price appreciation.

Vietnam’s pepper exports are charting an unprecedented course, with a staggering USD 1.5 billion generated within just the first 11 months of the year. This remarkable performance positions the industry to far exceed its previous record, with full-year 2025 exports now forecast to surpass an impressive USD 1.6 billion. This projection signifies a monumental achievement, eclipsing the industry’s highest export value set a decade ago.

The previous peak in export value for the Vietnamese pepper sector was recorded in 2016, reaching USD 1.42 billion. Following this high point, exports experienced a period of continuous decline, hitting a low in 2020 with a mere USD 666 million. However, through strategic efforts and favorable market conditions, pepper exports have made a dramatic return to the USD 1 billion mark, a milestone first achieved again in 2024. This resurgence underscores the resilience and adaptability of Vietnamese pepper producers and exporters.

Export Performance: Volume vs. Value

On the export front, the Vietnamese pepper sector continues to deliver positive results, albeit with nuanced trends. According to the latest Customs data, November 2025 saw Vietnam export 18,013 tons of pepper, generating a substantial USD 118.5 million. Cumulatively over the first 11 months of the year, total exports reached 223,242 tons, translating to an impressive turnover of USD 1.51 billion.

A key insight from these figures is the divergence between export volume and value. While export volume experienced a year-on-year decline, the overall export value witnessed a significant increase of over 24%. This positive financial performance is directly attributable to the robust and elevated export prices prevailing in the global market. The average export price in November stood at USD 6,580 per ton, and the 11-month average reached an even higher USD 6,764 per ton – a staggering 30% increase compared to the same period last year. This trend highlights a strategic shift towards higher-value exports, maximizing revenue despite potential fluctuations in volume.

Dominant Markets and Lingering Challenges

Despite the impressive resurgence, the Vietnamese pepper industry must navigate significant challenges to sustain its growth trajectory. While the U.S. and EU collectively account for over half of Vietnam’s total pepper export value, their stringent market requirements pose continuous hurdles. Maintaining market share and expanding further within these lucrative regions demands constant adaptation and adherence to evolving standards.

The Vietnam Pepper and Spice Association (VPSA) holds a highly optimistic outlook for the industry’s future. Based on current market trajectories and export performance, the VPSA forecasts that the full-year export revenue for 2025 is poised to surpass USD 1.6 billion. This projection is not just an increment but a significant leap, expected to establish a new historical record for the Vietnamese pepper sector. This anticipated success hinges on the sustained high export prices that have been a hallmark of recent performance, compensating for any year-on-year declines in export volume. The industry’s ability to command premium prices reflects its growing reputation for quality and reliability in the global market.