2025 // Week 52 – Vietnam’s Pepper Industry: Navigating Global Markets

Market Tone: Stability Amidst Surging Exports

Domestic pepper prices have maintained a steady course, ranging between VND 149,000 – 151,000/kg. This stability is a testament to the resilience of Vietnamese farmers and a favorable shift in market dynamics. The first half of December 2025 alone saw impressive export figures, with 9,401 tons of pepper shipped globally, generating a substantial revenue of USD 61.8 million.

This robust performance highlights the increasing global demand for Vietnamese pepper and the industry’s capacity to meet it. The consistent price point provides a strong foundation for continued growth and profitability within the sector.

Pepper price developments in the Central Highlands and Southeast from First 2023 to Nov 10, 2025 (Unit: VND/kg)

Farmer Resilience and Market Support

In the Central Highlands, farmers leverage intercropping pepper with coffee. The recovering coffee prices alleviate short-term financial pressure, empowering farmers to withhold pepper from sale.

Farmers often view pepper as a “store of value.” Their collective decision to cease selling at low prices compels traders to increase bids, demonstrating their market influence.

Underlying demand from China ahead of the Lunar New Year provides crucial support. Chinese traders capitalized on recent price dips, stepping up purchases and reinforcing market stability

Record-Breaking Export Turnover

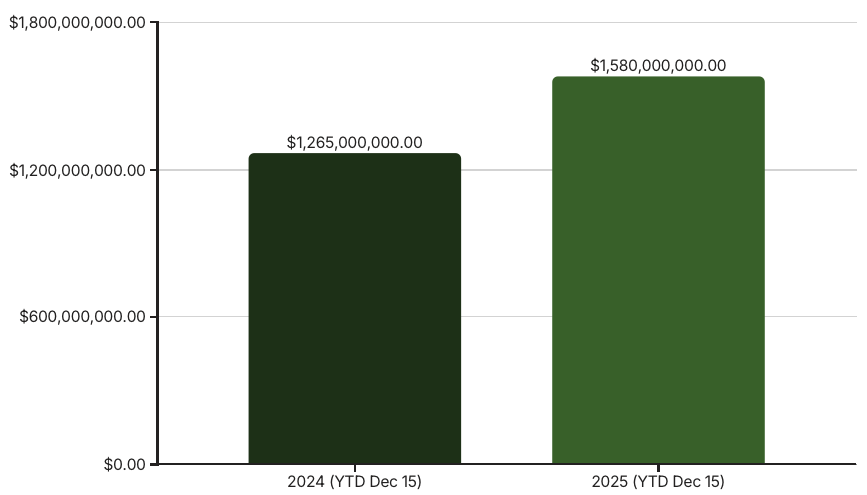

According to the Vietnam Pepper and Spice Association (VPSA), strong export performance in the first half of December has propelled year-to-date export turnover to an unprecedented USD 1.58 billion. This represents a remarkable 24.9% year-on-year increase, underscoring the industry’s robust growth trajectory and its significant contribution to the national economy.

Market Concentration and Associated Risks

Experts highlight that the US and EU continue to be Vietnam’s two largest markets, collectively accounting for over half of the total export value. While this strong presence in major economies has fueled rapid growth, it also introduces significant risks. Any adjustments in trade policies or tightening of import standards by these markets could have a substantial impact on Vietnam’s pepper exports.

Diversification is key to mitigating these risks. Over-reliance on a few dominant markets can leave the industry vulnerable to external shocks and policy changes. Proactive strategies are needed to explore and develop alternative markets to ensure long-term stability and sustained growth.

These underexploited markets offer a strategic avenue to offset potential volatility from the US–EU markets. By actively pursuing these regions, Vietnam can diversify its export portfolio and build a more resilient pepper industry.

Strategic Market Expansion Initiatives

To capitalize on emerging market opportunities, Vietnam must implement proactive and targeted strategies. This involves direct engagement and tailored approaches to penetrate these new territories effectively.

Comprehensive Strategy for Sustained Leadership

To secure Vietnam’s position as the world’s leading pepper producer and move up the global value chain, a multi-faceted and integrated strategy is indispensable. These are not merely aspirations but foundational pillars for future success.