2026 // Week 2 – Vietnam Pepper Market : Pepper Prices Soar Amidst Limited Supply

Pepper Prices Actions

Pepper price developments in the Central Highlands and Southeast from First 2023 to 12 Jan, 2026 (Unit: VND/kg)

Price Increase

By the end of last week, pepper prices in key producing regions ranged between VND 150,000 – 152,000 per kg, increasing by VND 1,000 – 1,500 per kg compared with the previous week. This upward trend reflects a broader market dynamic of heightened demand meeting constrained supply.

Tightened Supply

While Vietnam’s pepper output this year is estimated at around 180,000 tons, roughly in line with last year, carryover stocks have declined sharply. This reduction in available inventory is the primary driver behind the current price surge, creating a more favorable market for producers.

Global Constraints

Looking ahead to 2026, global supply is expected to remain constrained, largely due to the pervasive impacts of climate change on agricultural yields. This long-term outlook suggests that pepper prices will likely maintain their attractive levels, ensuring sustained profitability for growers.

Strategic Resilience: Vietnamese Pepper in 2025

In 2025, despite a landscape marked by global volatility and intense competition, Vietnamese pepper successfully maintained its strong position in international markets. This remarkable achievement is a testament to the strategic foresight and adaptive capabilities of the industry.

The sustained success was underpinned by clear and consistent strategic planning, coupled with accurate and objective assessments of global market developments. These proactive measures allowed Vietnamese exporters to navigate complex trade environments and capitalize on emerging opportunities, solidifying their market presence.

Beyond Raw Exports: The Rise of Value-Added Processing

2025 Export Performance: Volume and Value

The cumulative export data for 2025 underscores Vietnam’s dominant position in the global pepper market, showcasing impressive figures in both volume and value.

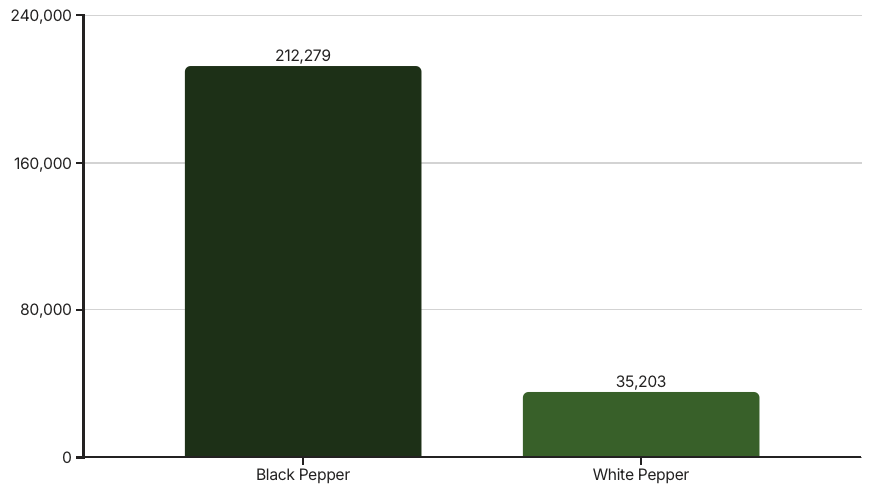

In total, Vietnam exported 247,482 tons of pepper of all types. This included a substantial 212,279 tons of black pepper and 35,203 tons of white pepper, highlighting the diversity of its export portfolio. The total export turnover for this period exceeded an impressive USD 1.66 billion.

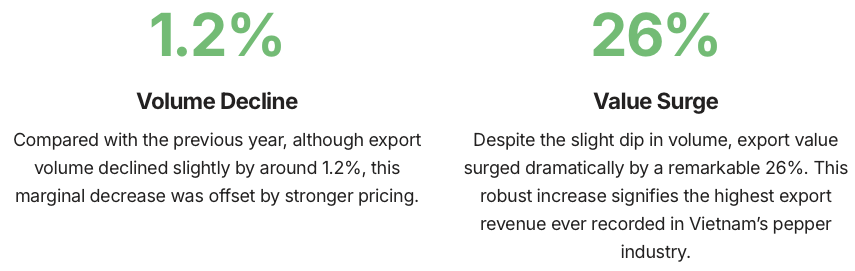

Record-Breaking Revenue Amidst Volume Shifts

While export volume saw a slight adjustment, the value of Vietnam’s pepper exports reached unprecedented heights in 2025, signaling a significant shift in market dynamics and product pricing.

This divergence between volume and value underscores the effectiveness of strategies focused on premiumization and capitalizing on higher global prices. It demonstrates the industry’s capacity to generate greater returns even with marginally lower quantities.

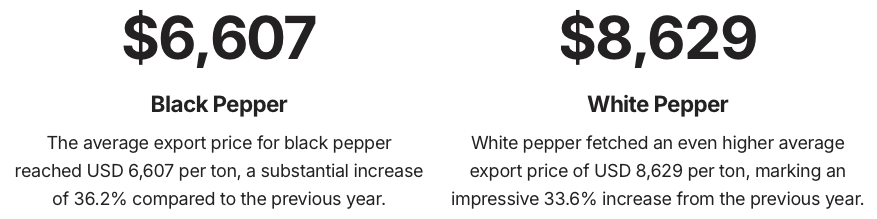

Pricing Power: Average Export Values in 2025

The average export prices for both black and white pepper in 2025 reflect the strong market conditions and the premium Vietnamese pepper commands globally. These figures highlight significant year-over-year growth, reinforcing the industry’s profitability.

These elevated average prices are a direct consequence of the tightened global supply and sustained demand, which have collectively positioned pepper as a highly valuable commodity. The outlook suggests that these favorable price trends are likely to continue, ensuring a profitable future for Vietnamese pepper growers and exporters.