2026 // Week 05 – Vietnam Pepper Market: Insights for Vietnamese Importers

Domestic Pepper Price Dynamics in Vietnam

Domestic pepper prices in Vietnam have shown a mixed performance, currently trading within the range of VND 149,000 – 152,000/kg. The market in January 2026 revealed subtle shifts across key producing regions.

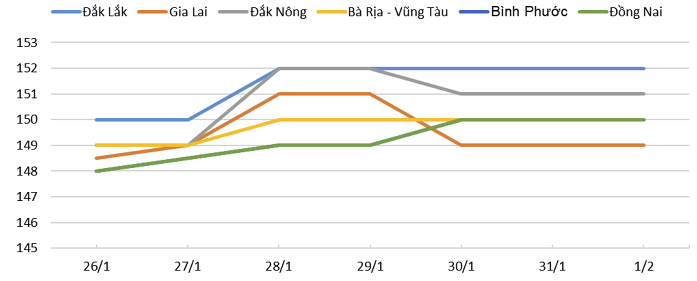

Price trends of pepper in the Central Highlands and Southeast regions during the week from 26-January to 01-February.

While the Đắk Lắk – Đắk Nông region recorded a slight increase, other major pepper-producing areas experienced either declines or remained stagnant. This regional disparity highlights the complex interplay of local supply-demand factors and broader market sentiment.

US Dollar Volatility and Its Impact on Commodity Prices

The US dollar experienced a highly volatile week, significantly influencing global commodity prices, including pepper. Initially, the dollar came under strong selling pressure, falling to a four-year low after statements by U.S. President Donald Trump on Sunday, January 25.

However, the greenback quickly rebounded following U.S. Treasury Secretary Scott Bessent’s declaration on Wednesday, January 27, reaffirming Washington’s strong-dollar policy and ruling out intervention to support the Japanese yen. This swift recovery signaled renewed confidence in the dollar’s stability.

Further strengthening occurred after President Trump announced the nomination of former Fed Governor Kevin Warsh as the next Chairman of the U.S. Federal Reserve. This development was perceived positively by markets, contributing to the dollar’s upward trajectory. The current rebound of the US dollar is expected to cap any significant upside potential for pepper prices in the near term, a critical factor for import planning.

US Pepper Imports: November 2025 Snapshot

According to the Vietnam Pepper and Spice Association (VPSA), citing ITC data, the United States’ pepper imports in November 2025 presented a mixed picture, showing both month-on-month and year-on-year variations.

Import Volume

Total imports reached 5,547 tons. This represents a 1.8% decline compared to the previous month, and a sharp 46.4% drop compared to November 2024. This significant year-on-year decrease suggests a notable contraction in immediate demand or a shift in purchasing patterns.

Import Value

The total import value stood at USD 43.3 million. Despite the volume decline, the import value saw a 1.4% increase month-on-month. This divergence indicates higher unit prices or a shift towards higher-value pepper varieties, cushioning the impact of reduced volume.

These figures provide a crucial short-term perspective on the U.S. market, signaling potential shifts in buying behavior that Vietnamese exporters must adapt to. The increase in import value despite lower volume points towards a resilient pricing environment.

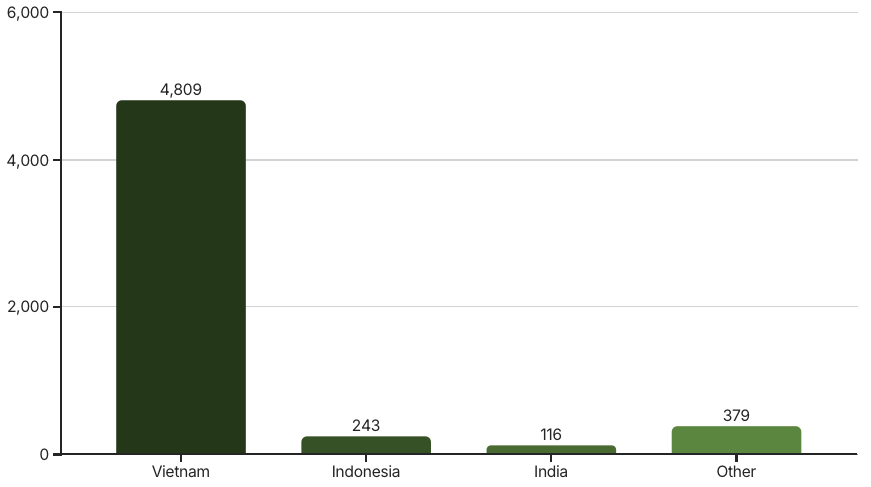

Key Suppliers to the US Market

Vietnam continues to dominate the U.S. pepper import market, reinforcing its position as a global leader. In November 2025, Vietnam exported 4,809 tons to the U.S., securing a substantial 86.7% market share.

Indonesia followed as the second-largest supplier, contributing 243 tons, which accounted for 4.4% of the total imports. India secured the third position with 116 tons, representing 2.1% of the market.

Despite a overall market contraction in terms of volume, Vietnam’s strong market share underscores its competitive edge and established trade relationships with U.S. buyers. Understanding the positioning of key competitors helps Vietnamese exporters strategize for sustained market presence and potential expansion.

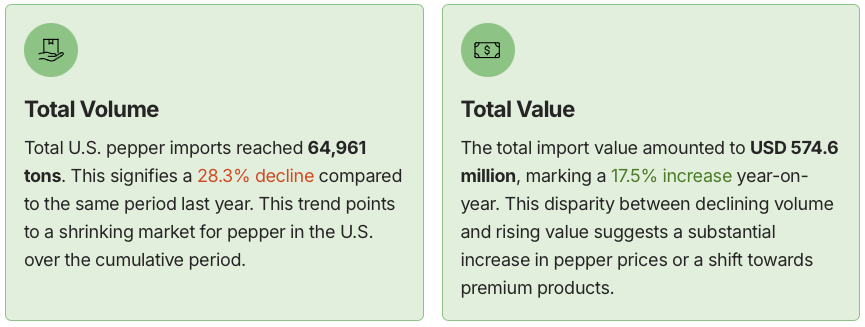

US Pepper Imports (January-November 2025)

The cumulative data for U.S. pepper imports from January 1 to November 30, 2025, reveals significant trends in market dynamics over the year, providing a broader perspective for long-term strategic planning.

Vietnam maintained its position as the primary supplier, accounting for 68.6% of total U.S. imports with 44,549 tons, despite a 37.0% year-on-year decrease in its own export volume to the U.S.

Indonesia ranked second with 13.1% of the market (8,478 tons), experiencing a significant 27.7% increase YoY. India followed with 10.6% (6,889 tons), showing a modest 0.7% increase YoY. These shifts indicate a competitive landscape where some suppliers are gaining market share while others face contractions.

Market Takeaway:

Price direction: sideways to slightly pressured short term

Macro (USD) + trade flow shifts are key drivers

High prices → buyers optimizing inventories & sourcing