30 September 2024

30 September 2024Week 40 – Pepper / Summary

Pepper prices today in key domestic regions range from 148,000 to 149,000 VND/kg.

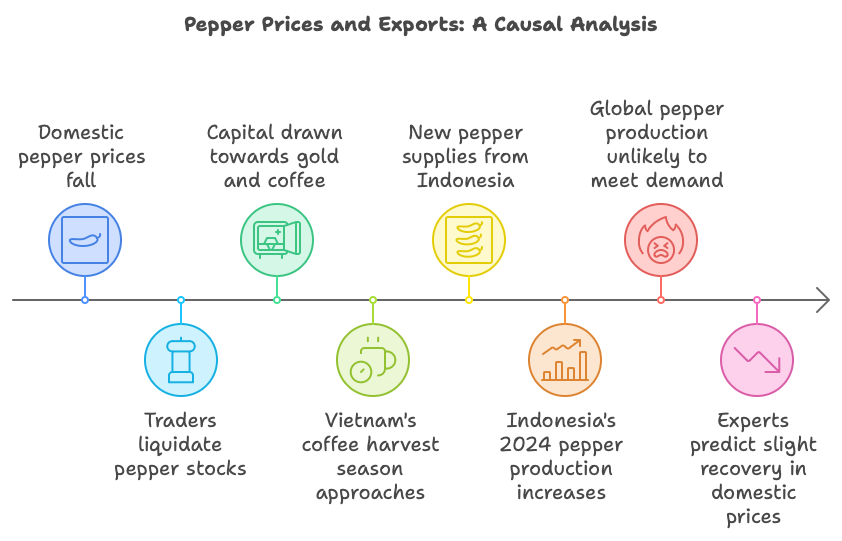

Morning prices remained stable compared to the same time yesterday. Last week, the domestic market experienced four consecutive days of decline, with prices only slightly recovering by the weekend. Overall, prices fell by 1,000 – 3,000 VND/kg during the week.

Several factors are pushing pepper prices down. Capital is being drawn towards gold and coffee. With Vietnam’s coffee harvest season approaching in Q4 2024, many traders are liquidating pepper stocks to prepare capital for coffee purchases, as Robusta prices are soaring.

Domestic trading has slowed due to limited supply in the local market. Additionally, new pepper supplies from Indonesia’s latest harvest are putting downward pressure on prices. Indonesia’s 2024 pepper production is expected to reach 85,000 tons, a 5% increase compared to last year, further contributing to price pressure.

However, experts remain optimistic, predicting that domestic pepper prices could rise above 160,000 VND/kg before Vietnam’s harvest. The main driver of price increases has been the global supply shortage. Looking ahead, over the next 3-5 years, global pepper production is unlikely to meet consumer demand.

For this week, experts foresee a slight recovery as gold prices, which have risen too high, may decrease. Orders preparing for Q4 should help support a rise in domestic pepper prices.

A foreign-invested company headquartered in the Netherlands reported that Vietnam’s processed pepper exports increased by over 50% compared to last year. Whole black pepper exports also saw a slight increase due to the absence of Chinese suppliers. Higher prices are encouraging replanting and intensive farming, with the company expecting a slight increase in production in the 2025 season.

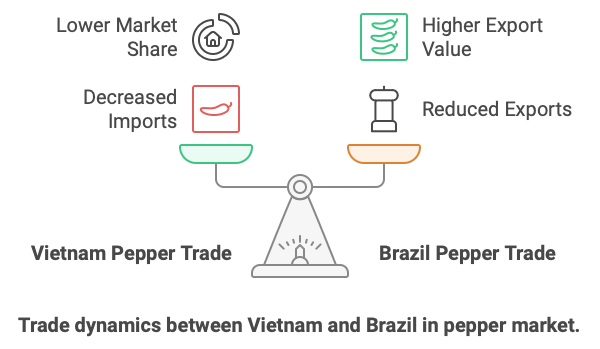

According to Brazil’s State Foreign Trade Statistics Center (Comex Stat), the country exported 45,699 tons of pepper in the first 8 months of the year, worth $183.4 million. Despite a 10.4% decline in volume, the export value increased by 19.3% compared to the same period in 2023.

Brazil’s main pepper export markets in the first 8 months included Vietnam, the UAE, Pakistan, India, and Senegal.

Notably, Brazil’s pepper exports to Vietnam, its largest consumer, dropped significantly in August to the lowest level in several months, reaching only 243 tons—a 48.5% decrease from the previous month and a 76.3% decline compared to the same period last year.

In total, Vietnam imported 6,625 tons of pepper from Brazil in the first 8 months of the year, worth $23.5 million, marking a 30.2% drop in volume and a 16.4% drop in value compared to last year. Vietnam’s share of Brazil’s total pepper exports fell from 18.6% to 14.5% during this period.