Week 45 – Vietnam Pepper Market: Stability Global Pressures

The Vietnamese pepper market is experiencing a period of relative stability, despite facing global pressures and shifting dynamics. Domestic prices have held steady in key regions, trading between 143,500 and 144,500 VND/kg. This stability comes after a week of modest declines, reflecting the complex interplay of local and international factors affecting the industry.

As Vietnam maintains its position as a leading global pepper exporter, the market faces challenges from decreased demand and currency fluctuations. However, limited supply and strong export values have kept prices significantly higher than previous years, presenting both opportunities and concerns for industry stakeholders.

Domestic Pepper Price Trends

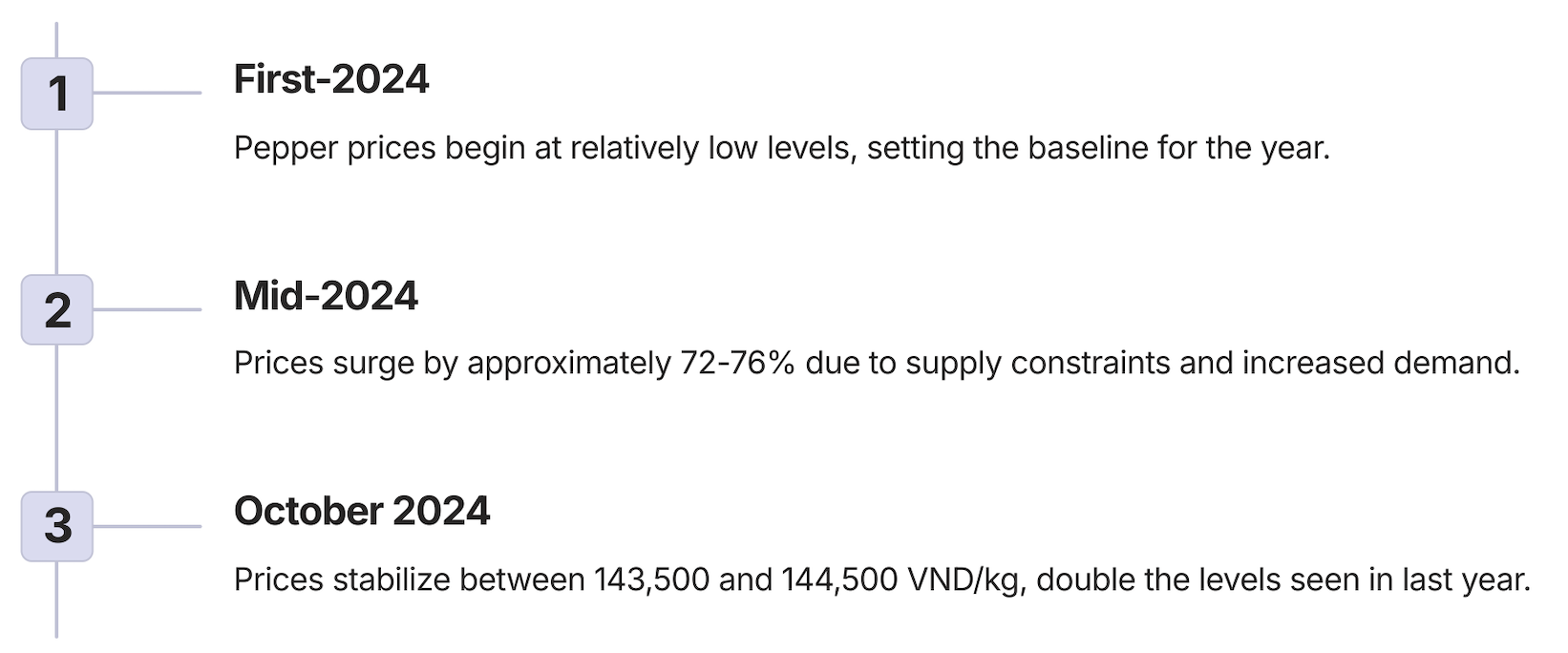

The Vietnamese domestic pepper market has shown remarkable stability in recent days, with prices hovering between 143,500 and 144,500 VND/kg in key production regions. This stability comes after a week that saw an average price decline of 2,000 – 2,500 VND/kg, indicating a potential market correction.

Despite the recent dip, pepper prices remain significantly elevated compared to earlier in the year. Current prices are approximately 72-76% higher than those observed at the beginning of 2024, and have doubled compared to the same period in 2023. This substantial price increase can be attributed to a combination of factors, including limited supply, increased production costs, and speculative holding by farmers anticipating further price hikes.

Global Market Dynamics

The global pepper market has exhibited varied trends across different regions. Southeast Asian markets, including major producers like Indonesia and Malaysia, have experienced downward pressure on prices. This trend is largely attributed to increased production in these countries and competitive pricing strategies to gain market share.

In contrast, the Indian pepper market has shown signs of recovery after a month-long decline. This rebound is likely due to a combination of factors, including increased domestic demand, reduced carry-over stocks, and government interventions to support local farmers. The divergent trends in Southeast Asia and India highlight the complex and often localized nature of the global pepper trade.

Vietnam’s Pepper Export Performance

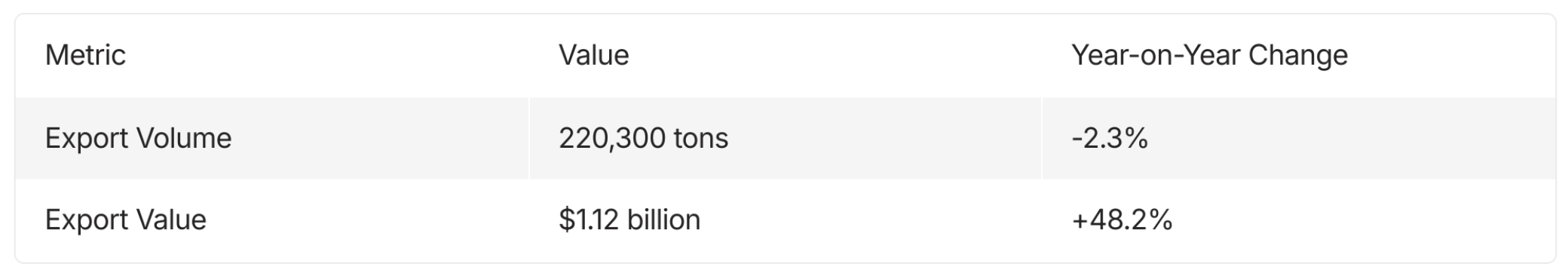

Vietnam’s pepper export sector has achieved a significant milestone in 2024, with export values surpassing $1 billion for the first time in years. In the first ten months of 2024, Vietnam exported approximately 220,300 tons of pepper, generating an estimated value of $1.12 billion. This represents a remarkable 48.2% increase in export value compared to the same period last year, despite a 2.3% decrease in export volume.

The discrepancy between volume and value trends underscores the substantial price appreciation in the global pepper market. It also highlights Vietnam’s ability to capitalize on higher prices, potentially through improved quality standards, strategic market positioning, or favorable trade agreements. However, the decline in export volume suggests potential challenges in maintaining market share or meeting production targets.

Import Dynamics and Domestic Supply Challenges

Vietnam’s pepper import activities have seen a significant uptick in 2024, with companies spending $108 million (approximately 2.7 trillion VND) on pepper imports in the first ten months of the year. This represents a 38.2% increase compared to the same period in 2023. The primary sources of these imports are Brazil, Indonesia, and Cambodia, reflecting a diversification of supply chains to meet domestic demand.

The surge in imports can be attributed to several factors, including reduced domestic production due to prolonged drought conditions and strategic stock holding by local farmers anticipating higher prices. The drought has particularly affected key pepper-growing regions, exacerbating supply shortages and contributing to the overall tightness in the market. This situation underscores the vulnerability of Vietnam’s pepper industry to climate-related risks and the need for adaptive strategies to ensure supply stability.

Market Outlook and Price Projections

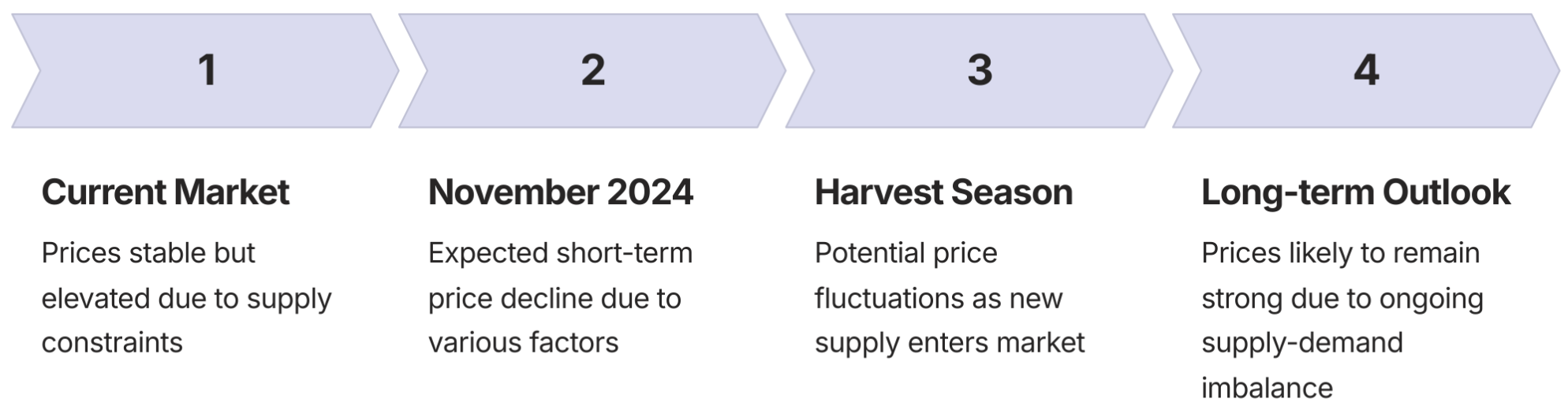

As Vietnam approaches its pepper harvest season, experts anticipate a production of around 170,000 tons, which is expected to account for 35-40% of the global supply. This significant market share positions Vietnam to potentially influence global pepper prices, which may experience further fluctuations as the harvest progresses.

Despite the upcoming harvest, the overall supply is projected to remain lower than demand, supporting the likelihood of continued strong pepper prices. However, short-term price declines are anticipated, particularly in November 2024. This temporary dip may be influenced by various factors, including pre-harvest selling pressure, global economic uncertainties, and the potential impact of the U.S. presidential election on market sentiment.

Key Export Markets and Shifting Dynamics

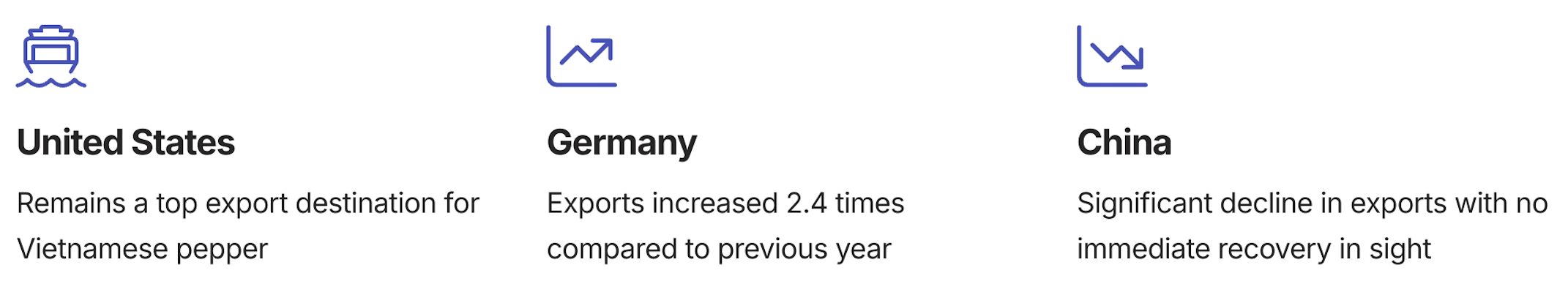

In the first nine months of 2024, the United States, Germany, and the United Arab Emirates emerged as the largest export markets for Vietnamese pepper, collectively accounting for 44.2% of the total pepper export value. This concentration of exports highlights the importance of maintaining strong trade relationships with these key partners.

Notably, pepper exports to Germany have seen extraordinary growth, increasing 2.4 times compared to the previous year. This surge may be attributed to factors such as increased demand in the European market, successful trade negotiations, or a shift in German import preferences towards Vietnamese pepper. Conversely, exports to China have experienced a significant decline with no immediate signs of recovery, potentially due to geopolitical tensions, changes in Chinese import regulations, or increased domestic production in China.

Long-term Prospects and Industry Challenges

The long-term outlook for the Vietnamese pepper industry remains cautiously optimistic. Experts and businesses anticipate continued market growth, driven by persistent supply challenges and the potential for global economic recovery. However, this positive outlook is tempered by several significant challenges that the industry must address to ensure sustainable growth.

Key concerns include the impact of climate change on pepper production, the need for improved agricultural practices to enhance yield and quality, and the importance of diversifying export markets to reduce dependency on a few key buyers. Additionally, the industry must navigate the delicate balance between pepper and coffee production, as capital shifts between these crops can significantly impact supply dynamics. Addressing these challenges will be crucial for maintaining Vietnam’s position as a leading global pepper producer and exporter in the years to come.

Or please see the report file below by click to download it.

Week-45-Vietnam-Pepper-Market-Overview-Stability-Amidst-Global-Pressures