2025 // Week 16 – Vietnam Pepper Market : Impact of U.S. Tariff Policy on Vietnamese Pepper Exports

Tariff Uncertainty and Market Fluctuations

The announcement of potential retaliatory tariffs from the U.S. government on Vietnam’s pepper exports had an immediate and significant impact on the market. Importers, uncertain about the future of trade relations between the two countries, adopted a wait-and-see approach, significantly reducing purchases and leading to market stagnation. This triggered a sharp decline in pepper prices, as supply exceeded demand, resulting in a loss of revenue for Vietnamese exporters.

The Trump administration’s imposition of a 10% import tariff on all goods entering the U.S. further intensified these concerns. Vietnamese pepper exporters, who had already signed long-term delivery contracts with U.S. importers, faced the possibility of renegotiated prices due to the added tax burden. The uncertainty surrounding the tariff rate and its potential impact on future shipments created a challenging business environment.

*Companies are already adding a ‘Trump surcharge’ to bills to deal with tariff price increases

Tariff Postponement and Market Rebound

However, a significant shift occurred when the U.S. government unexpectedly announced a 90-day postponement of the retaliatory tariffs. This news brought a wave of optimism to the pepper market, as importers, relieved by the temporary reprieve, immediately increased their purchases. The uncertainty surrounding the future tariff rate fueled demand, pushing pepper prices upward.

The combination of the tariff postponement and growing information about lower pepper yields in Vietnam further bolstered market sentiment. The prospect of reduced supply for the coming harvest contributed to the price rebound, with hopes of reaching 160,000 VND/kg, a positive sign for Vietnamese farmers and exporters.

Current Market Trends and Price Volatility

Despite the recent price rebound, the market continues to experience volatility. While pepper prices have recovered somewhat, reaching a range of 155,000 to 157,000 VND/kg, they remain lower than previous levels. The International Pepper Community (IPC) has reported a decline in Vietnam’s export pepper prices by 500 USD/ton, indicating a downward trend in global markets.

The U.S. dollar’s weakening after a period of strength has also contributed to the increase in USD-denominated pepper prices. This suggests that while international prices are declining, Vietnamese exporters may not be experiencing as significant a drop in revenue due to the favorable currency exchange rate.

VPSA Recommendations and Long-Term Perspectives

Recognizing the challenges facing the pepper sector, the Vietnam Pepper and Spice Association (VPSA) has issued key recommendations to ensure long-term stability and growth. The VPSA advises pepper farmers to maintain their cultivation areas, avoid panic selling, and resist spreading harmful rumors. They also emphasize the importance of adopting sustainable farming practices to enhance product quality and value.

While the U.S. tariff situation has created uncertainty, the VPSA remains cautiously optimistic about the future. The postponement of retaliatory tariffs offers a valuable opportunity to stabilize the market and promote long-term growth. By embracing sustainable practices and maintaining a strategic approach, the Vietnamese pepper sector can navigate these challenges and capitalize on future market opportunities.

Vietnam’s Pepper Export Performance in Q1 2025

Despite the trade uncertainties, Vietnam’s pepper export performance in Q1 2025 demonstrates resilience. Despite a decline in export volume compared to the same period last year, export value increased significantly, indicating a stronger demand for Vietnamese pepper.

|

Export Category |

Q1 2025 Volume (tons) |

Q1 2025 Value (USD million) |

Year-on-Year Change (%) |

|

Black Pepper |

47,660 |

326.6 |

+38.6 |

The average export price of black pepper in Q1 2025 reached 6,711 USD/ton, reflecting a substantial increase of 94.9% compared to the previous year. White pepper prices also saw a notable rise, reaching 8,617 USD/ton, an increase of 73.9% year-on-year.

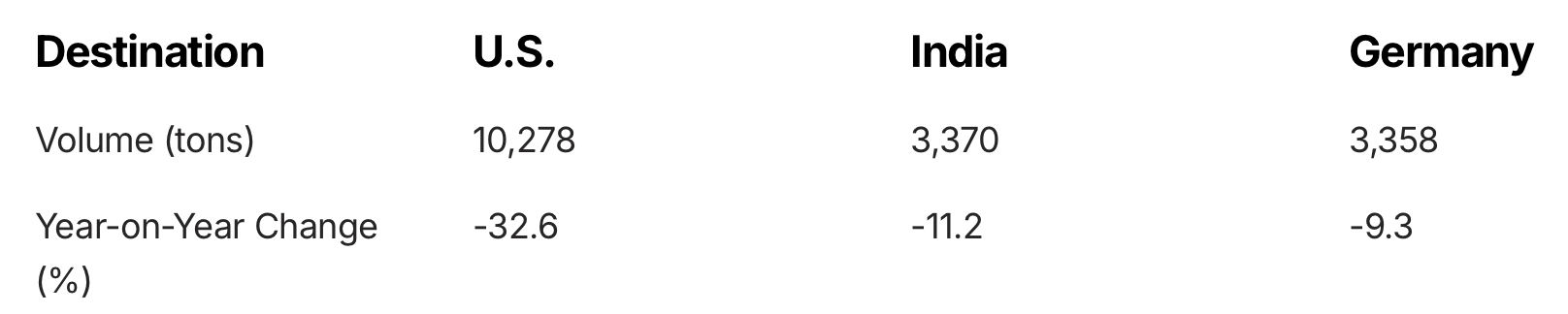

Vietnam’s Pepper Export Market Share by Destination

While the U.S. remains Vietnam’s largest pepper export market, its share has declined compared to the previous year, prompting a need to explore alternative markets. Several other key export destinations have experienced fluctuations in volume, reflecting the dynamic and evolving global demand for Vietnamese pepper. Understanding these shifts is crucial for Vietnamese exporters to strategically adapt and maintain competitiveness.

The significant increase in exports to China suggests a growing demand for Vietnamese pepper in this market, presenting a considerable opportunity for Vietnamese exporters. Furthermore, the rise in exports to the Netherlands indicates a strengthening presence in the European market. These trends highlight the importance of diversifying export markets and strategically exploring new opportunities for growth and expansion in the future, ensuring resilience against market fluctuations and maintaining a competitive edge.