2025 // Week 17 – Vietnam Pepper Market Update: Prices, Production Trends, and Export Outlook

Current Domestic Price

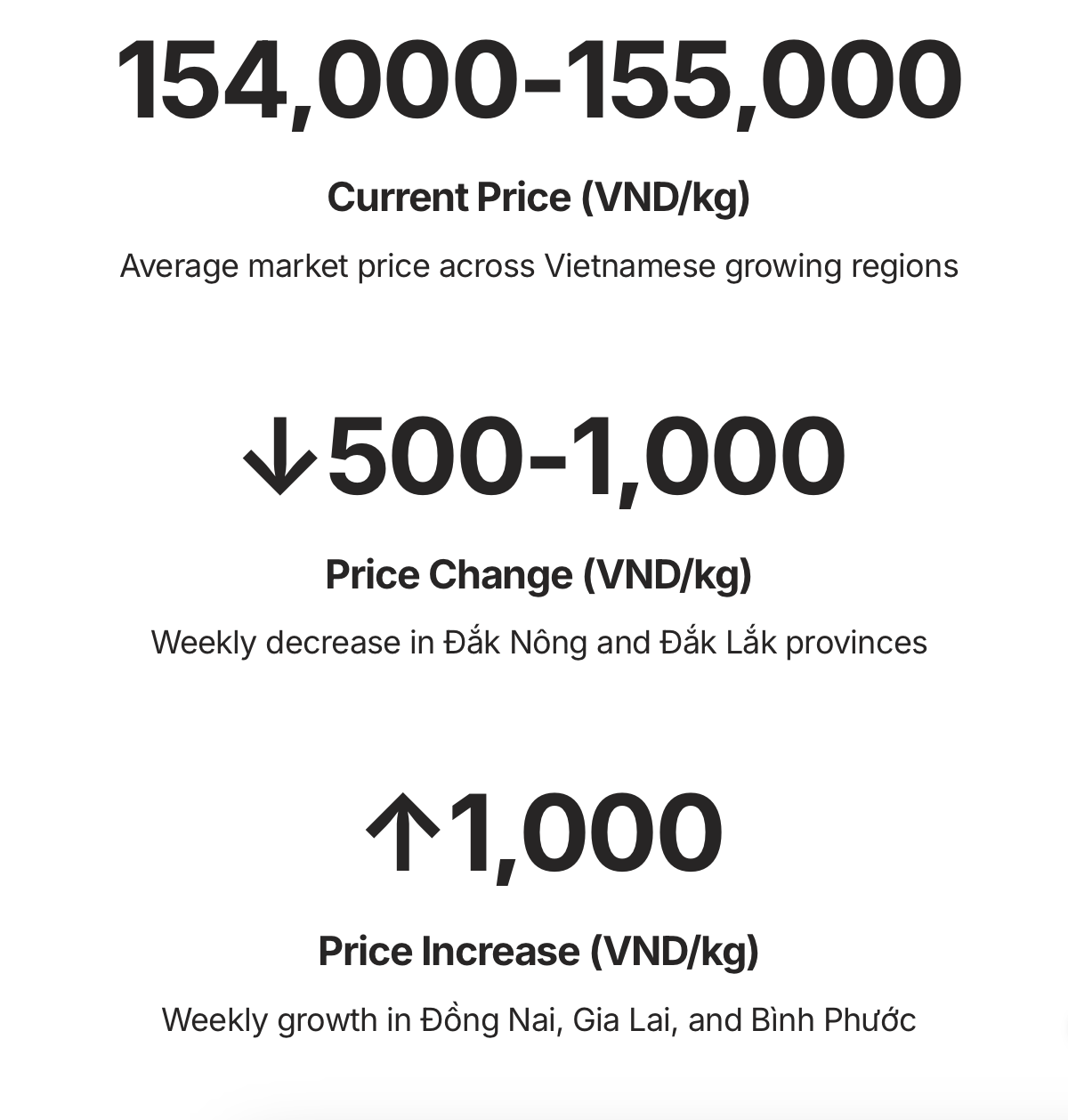

The Vietnamese pepper market currently demonstrates notable regional variations in pricing structures. As of the latest trading sessions, pepper prices are hovering between 154,000 and 155,000 VND/kg, reflecting the market’s responsiveness to both local and international factors. This pricing represents a significant premium compared to historical averages, providing favorable conditions for producers despite production challenges.

The past week has revealed a mixed price movement pattern across Vietnam’s major pepper-growing provinces. The Central Highlands region, particularly Đắk Nông and Đắk Lắk provinces, experienced a slight downward adjustment of 500-1,000 VND/kg. This modest correction follows several weeks of strong price performance and may represent a temporary consolidation rather than a reversal of the broader upward trend.

In contrast, southern regions displayed varied price behaviors. Bà Rịa-Vũng Tàu province maintained stable pricing levels throughout the week, demonstrating market resilience in this traditional pepper-growing area. Meanwhile, Đồng Nai, Gia Lai, and Bình Phước provinces recorded positive momentum with price increases of approximately 1,000 VND/kg, suggesting stronger demand dynamics in these regions.

A notable development in the domestic market has been the convergence of interprovincial price disparities. The price differential between Vietnam’s pepper-growing regions has narrowed considerably, with insignificant variations compared to previous months. This normalization indicates a maturing market with improved information flow and logistics between production zones, benefiting both farmers and traders through more predictable pricing mechanisms.

Global Price and Export Market

A significant development in the international pepper market has been the International Pepper Community’s (IPC) upward adjustment of Vietnam’s export price by $200 per ton. This price revision reflects strengthening fundamentals in the global pepper trade and reinforces Vietnam’s position as a price-setting origin despite increased competition from emerging producers. The adjustment acknowledges both the quality parameters of Vietnamese pepper and the supply constraints affecting global availability.

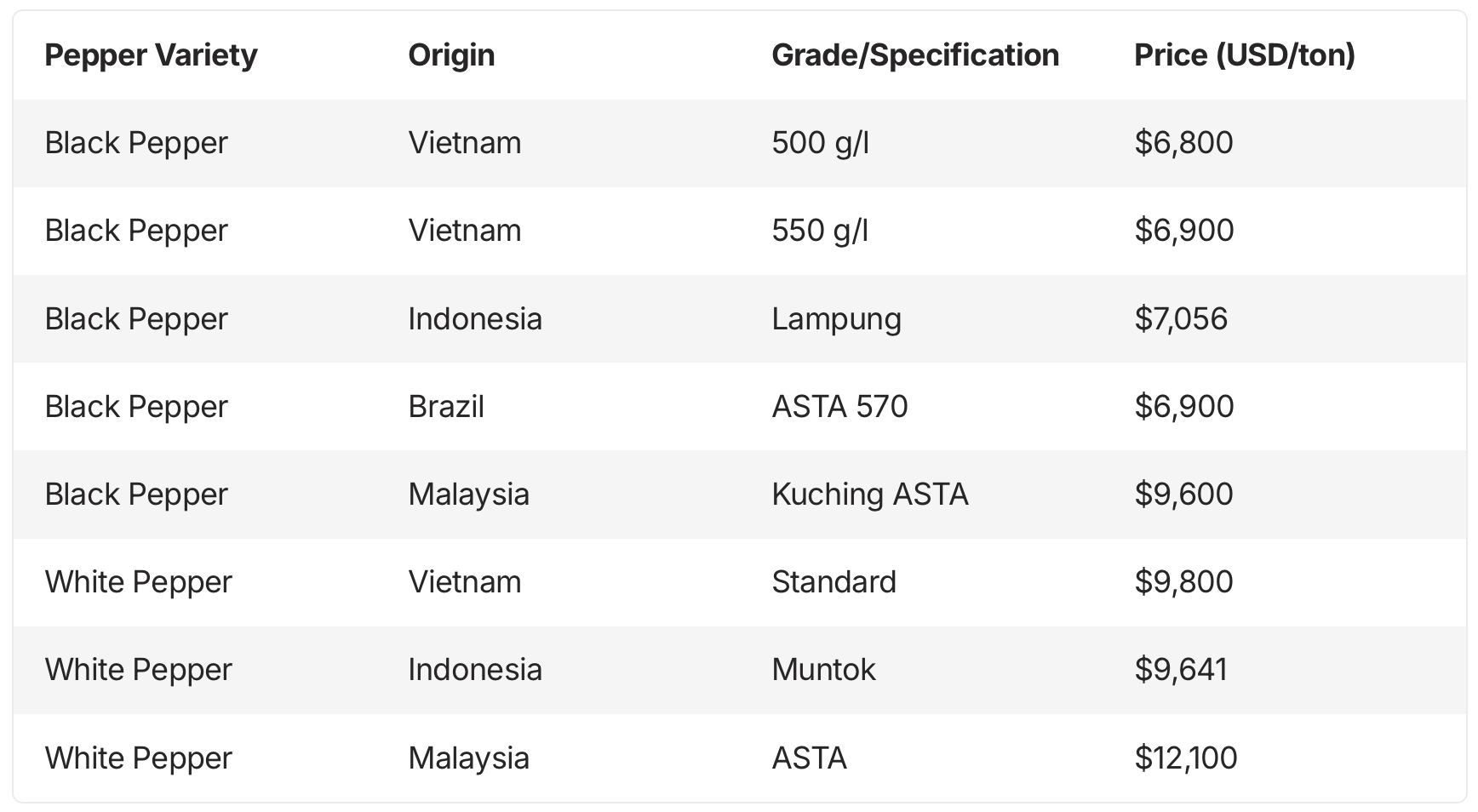

Vietnam’s black pepper export prices now stand at $6,800 per ton for 500 g/l density and $6,900 per ton for the premium 550 g/l density specification. These price points position Vietnamese black pepper at a moderate discount to Malaysian Kuching ASTA grade ($9,600 per ton) but at comparable levels to Indonesian Lampung ($7,056 per ton) and Brazilian ASTA 570 grade ($6,900 per ton). The relative value proposition of Vietnamese pepper remains compelling to international buyers, balancing quality considerations with competitive pricing.

In the white pepper segment, Vietnamese exports are currently valued at $9,800 per ton, representing a significant premium over black pepper variants but remaining competitive against Indonesian Muntok grade ($9,641 per ton) and substantially more affordable than Malaysian ASTA grade white pepper ($12,100 per ton). This pricing structure reflects the specialized processing requirements and limited availability of white pepper globally, with Vietnam maintaining an important supply role in this higher-value market segment.

*Source: IPC

Production Challenges and Climate Impact

Vietnam’s pepper production outlook for 2025 presents significant challenges, primarily driven by adverse weather conditions affecting the country’s key growing regions. Industry analysts project a continued decline in overall output, extending a multi-year downward trend in national production volumes. This contraction comes despite Vietnam’s position as the world’s largest pepper exporter, raising concerns about global supply adequacy in the coming marketing year.

The Central Highlands and Southeast regions, which collectively account for over 85% of Vietnam’s pepper cultivation area, have been particularly affected by prolonged drought conditions in the early months of 2025. These arid conditions have coincided with critical vegetative development and flowering stages, potentially compromising both yield potential and quality parameters. Water stress during these phenological phases typically results in reduced berry formation and smaller fruit size, directly impacting harvested volumes.

While recent precipitation events have provided some relief to drought-affected areas, the timing of rainfall introduces additional complexities to production forecasts. For gardens where harvest has already concluded, unseasonal rainfall may disrupt the normal flower bud differentiation process, potentially compromising next year’s reproductive cycle. This biological response creates concern about the possibility of consecutive suboptimal production years, which could fundamentally reshape market dynamics over the medium term.

Market Outlook And Sentiment

Vietnamese pepper farmers are displaying remarkable market discipline despite production challenges, maintaining a cautious selling approach that reflects their improved financial position and market awareness. Unlike previous seasons when post-harvest selling pressure would typically drive prices downward, the current market environment demonstrates a more measured liquidation pattern. This behavioral shift has significant implications for price discovery and inventory management throughout the supply chain.

The impending conclusion of the harvest season by April 2025 introduces additional supply-side constraints that are expected to underpin prices. With production volumes already compromised by adverse weather conditions, the natural seasonal reduction in fresh harvest arrivals will further tighten available market supplies. This timing coincides with peak export execution periods for contracts negotiated earlier in the calendar year, creating potential logistics bottlenecks and quality premiums for promptly available merchandise.

Export companies have strategically diversified their destination markets in response to trade policy challenges, particularly the countervailing duty pressures from the United States market. This deliberate pivoting has resulted in accelerated sales to alternative destinations including the European Union, India, and Middle Eastern markets. The reorientation of trade flows demonstrates the adaptability of Vietnam’s export sector while helping maintain overall export volumes despite market-specific challenges.