2025 // Week 37 – Vietnam Pepper Market Report: Export Performance and Price Trends

Current Domestic Price Trends

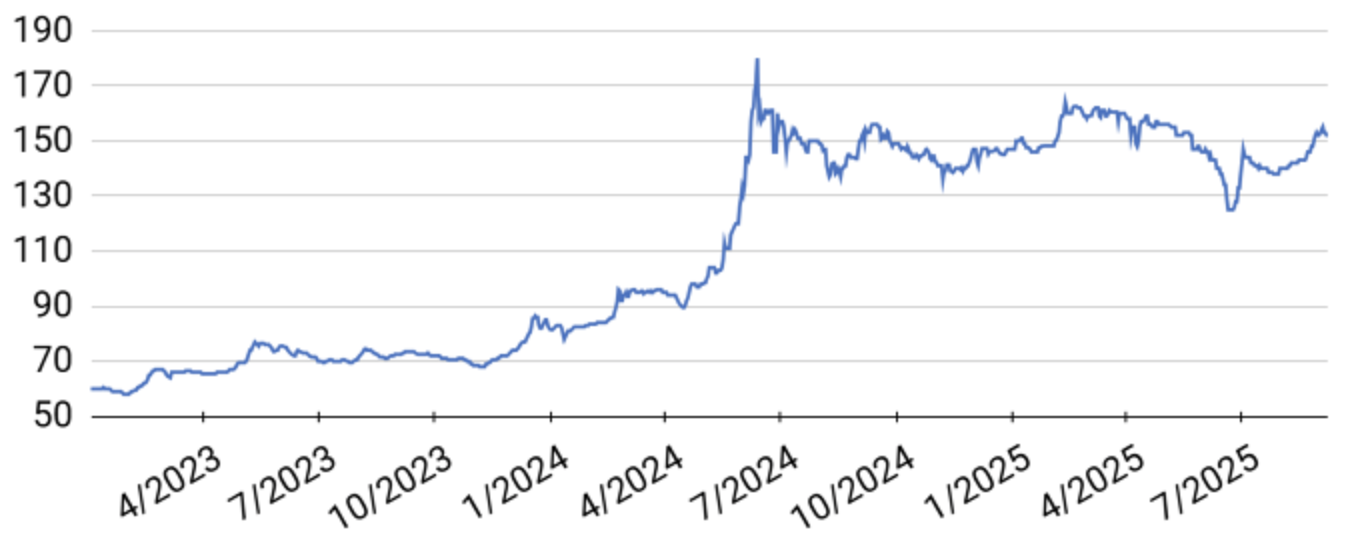

As of early September 2025, Vietnam’s domestic pepper prices remain strong, trading in the range of 152,000 – 154,000 VND/kg. This represents a significant price level compared to historical averages and continues the strong upward momentum seen throughout 2025. Regional price variations have emerged in recent weeks, with Gia Lai province experiencing a slight decline during the first week of September, while other major growing regions have maintained stable pricing.

Pepper price developments in the Central Highlands and Southeast from First 2023 to Sept 08, 2025 (Unit: VND/kg)

Pepper price developments in the Central Highlands and Southeast from First 2023 to Sept 08, 2025 (Unit: VND/kg)

Export Performance Analysis

By the end of August 2025, Vietnam had exported a total of 166,510 tons of pepper of all types, according to the Vietnam Pepper and Spice Association (VPSA), generating an impressive export turnover of $1.1278 billion USD. This performance demonstrates a fascinating market dynamic where export volume has actually decreased by 9.4% compared to the same period in 2024, yet export turnover has increased by a substantial 28%. This inverse relationship between volume and value highlights the extraordinary price appreciation that has characterized the global pepper market in 2025.

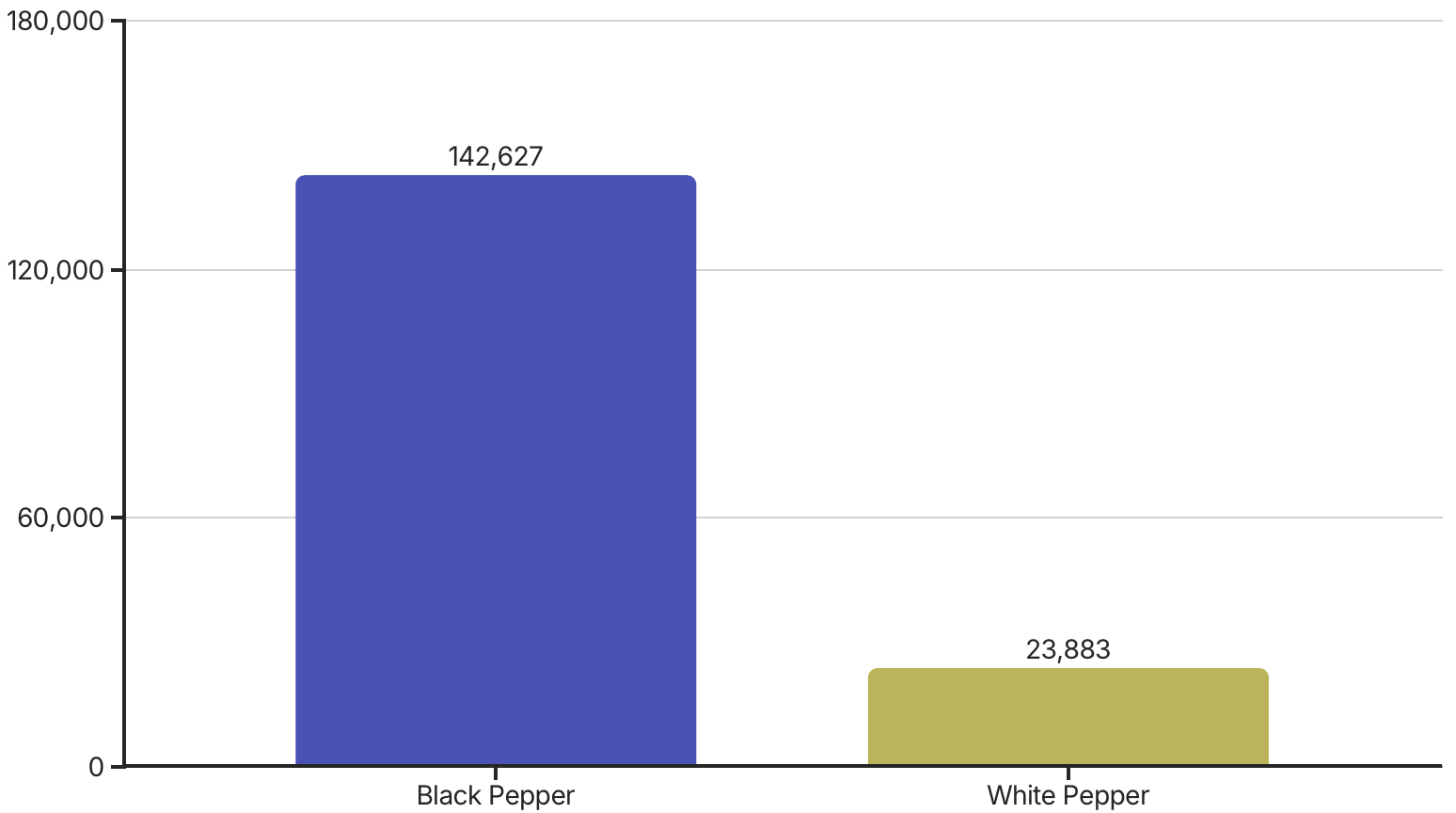

The export breakdown by pepper type reveals that black pepper continues to dominate Vietnam’s export portfolio, accounting for approximately 85.7% of total export volume with 142,627 tons shipped. White pepper, which commands a premium price, represented 14.3% of export volume with 23,883 tons. In value terms, black pepper exports generated $930.4 million USD (82.5% of total value), while white pepper contributed $193.4 million USD (17.5% of total value).

With the 2024 full-year export performance setting a record of $1.32 billion USD, the current 2025 eight-month performance of $1.1278 billion already represents 85.4% of that record total. This puts Vietnam’s pepper industry on a clear trajectory to potentially establish a new annual export value record, assuming current price levels are maintained through the final quarter.

The average export prices achieved during this period underscore the exceptional market conditions, with black pepper averaging $6,666 USD per ton (a remarkable 41.5% increase year-over-year) and white pepper commanding $8,732 USD per ton (a 38% increase year-over-year). These substantial price increases have more than compensated for the reduced export volume, resulting in the significant growth in overall export value.

Export Markets

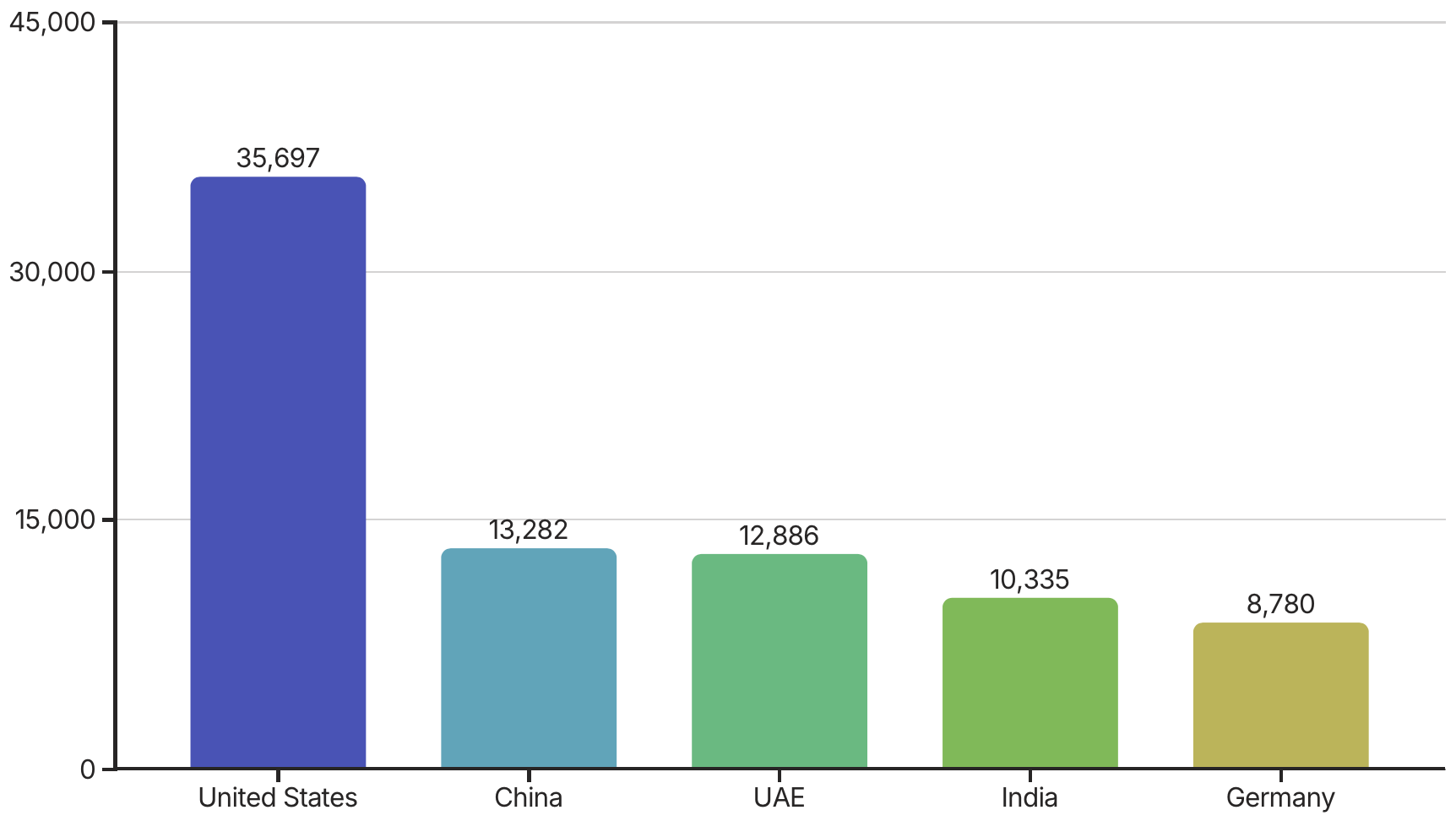

The United States remains Vietnam’s primary export destination, receiving 35,697 tons and accounting for 21.4% of total export volume. However, this represents a significant 31.1% decrease compared to the same period in 2024. Industry analysts attribute this decline to several factors, including high U.S. inventory levels from record 2024 imports, inflationary pressures affecting food manufacturers, and increased scrutiny of origin documentation.

In contrast, China has emerged as a growth market, importing 13,282 tons of Vietnamese pepper—an impressive 58.3% increase year-over-year. This surge reflects China’s economic recovery, growing consumer demand for spices, and potentially some stockpiling behavior in response to global supply uncertainties. The United Arab Emirates has also strengthened its position as a re-export hub, increasing imports by 9.7% to 12,886 tons.

India’s continued strong import performance (10,335 tons, up 13.7%) is noteworthy given its own significant domestic pepper production. Market analysts suggest that Vietnamese pepper’s competitive quality-to-price ratio and India’s growing food processing sector are driving this demand. Germany rounds out the top five markets with 8,780 tons, serving as a gateway to the broader European market where stringent quality and sustainability requirements continue to influence trade patterns.

Import Dynamics and Re-Export Challenges

In the most recent reporting period, Cambodia and Brazil emerged as Vietnam’s two largest pepper suppliers, with import volumes of 1,418 tons and 1,024 tons respectively. This represents a significant shift from earlier patterns observed in Q1 2025, when according to the former Standing Vice Chairman of the Chu Se Pepper Association, Vietnamese firms imported substantially higher volumes—reportedly tens of thousands of tons from Brazil and Indonesia, doubling the previous year’s import volume.

The dramatic reduction in imports since Q1 reflects changing economic calculations for Vietnamese traders. With Brazilian pepper prices surging in recent months and Vietnam’s own domestic prices maintaining strength, the arbitrage opportunity that previously made imports attractive has diminished significantly. As noted by industry experts:

A significant factor constraining Vietnam’s pepper imports for re-export purposes has been the high tariffs imposed by key destination markets, particularly the United States. These tariffs on re-exported pepper have created both increased costs and heightened risks regarding proof of origin documentation. Vietnamese exporters must now carefully document the origin of all pepper shipments, especially those destined for markets with stringent origin verification requirements.