2025 // Week 38 – Vietnam Pepper Market Report: Price Pressures and Global Supply Dynamics

Regional Price Movements

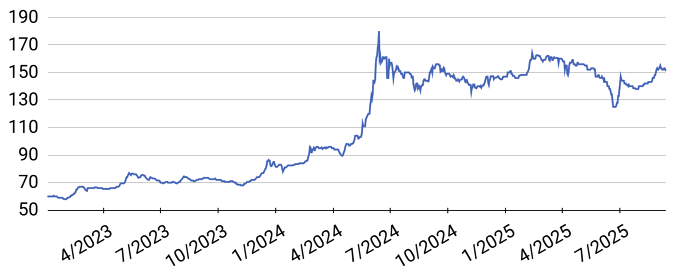

Pepper price developments in the Central Highlands and Southeast from First 2023 to Sept 15, 2025 (Unit: VND/kg)

Vietnamese pepper prices have stabilized within a tight range of 148,000-152,000 VND/kg across key producing provinces this morning. The country’s Import-Export Department forecasts that domestic prices may remain elevated if supply constraints persist. This price strength reflects underlying supply tightness, particularly as a significant portion of the crop was already committed through forward contracts earlier in the year.

Demand from both exporters and local consumption markets remains robust, supporting current pricing levels. The combination of limited immediate supply availability and steady demand fundamentals continues to underpin Vietnamese market strength.

Global Market Trends

Vietnam: Seasonal Progress

Rainfall has begun decreasing across Vietnam’s pepper-growing regions, with flowering and fruit-setting processes currently underway in many Central Highlands areas. However, early rainfall patterns have created uneven flowering and increased vegetative growth in several locations, potentially impacting yield consistency.

India: Weather Challenges

Pepper-growing regions continue experiencing scattered rainfall patterns. This year’s prolonged wet conditions have significantly increased pest infestations, raising concerns about next season’s crop yield potential. The extended moisture exposure creates ideal conditions for fungal diseases and insect pressure.

Indonesia: Harvest Underway

Harvesting operations have commenced in Lampung and neighboring provinces, though this year’s production has declined due to heavy rainfall earlier in the growing season. Operations in South Sumatra and Bengkulu provinces are expected to accelerate over the coming weeks as weather conditions improve.

Brazil: Mixed Progress

The mid-season harvest in Espírito Santo state has concluded, though labor shortages constrained harvesting pace throughout the season. Northern Pará operations began in August, with output expectations remaining positive despite logistical challenges affecting collection efficiency.

Supply Chain Dynamics and Inventory Management

Despite substantial stockpiles remaining in both Vietnam and Brazil, growers and traders are demonstrating remarkable restraint in their selling strategies. This measured approach to inventory liquidation reflects strong financial positions among market participants and strategic positioning for potential price appreciation.

The completion of Brazil’s mid-season harvest has effectively removed selling pressure from that market segment. Combined with reduced urgency from financially stable market participants, this dynamic has contributed to price stability and reduced volatility in spot markets. Traders report that inventory holders are increasingly selective about sale timing, preferring to wait for optimal pricing opportunities rather than pursuing immediate liquidity.

Stronger demand from Chinese markets has provided substantial support to global pepper pricing. China’s robust economic recovery and increased food service activity have driven import demand higher, creating upward pressure on international prices. Chinese buyers are reportedly increasing their procurement activities ahead of anticipated seasonal demand spikes.

This demand surge coincides with China’s strategic inventory building ahead of major festive periods, when spice consumption traditionally increases. The combination of immediate consumption needs and forward-looking inventory strategies has created sustained buying pressure that supports current price levels across major exporting regions.

Market Dynamics and Strategic Implications

The convergence of supply constraints, strong demand fundamentals, and strategic inventory management suggests continued price support in the near term. Vietnam’s Import-Export Department analysis indicates that tight supply conditions may persist, particularly given the high percentage of crop already committed through forward sales earlier in the year.

For traders and exporters, the current environment presents opportunities for strategic positioning. The financial strength of producers and their willingness to hold inventory suggests limited downside price risk in the immediate term.

Brazilian exporters face particular challenges from potential U.S. tariff implementation, which could redirect trade flows and create arbitrage opportunities in other markets. The 50% tariff concern highlights the importance of diversifying export destinations and developing contingency strategies for major market disruptions.