2025 // Week 42 – Vietnam Pepper Market Report: Price Stability Amid Shifting Global Demand

Current Market Dynamics and Price Trends

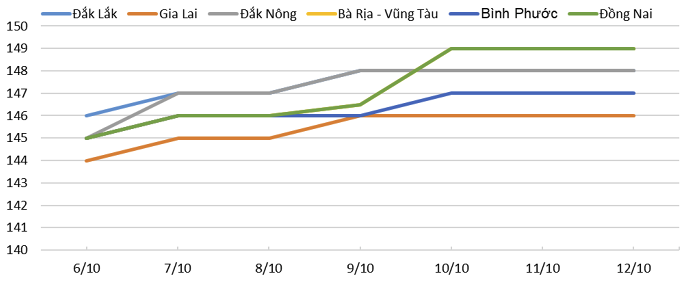

Pepper price developments in the Central Highlands and Southeast regions during the week from October 06 to October 12, 2025

Vietnam’s domestic pepper market has entered a period of notable stability, with prices holding firm between 146,000 – 149,000 VND/kg throughout recent trading sessions. This price consolidation. represents a significant shift from the gradual declines observed earlier in 2025, suggesting the market has found a sustainable equilibrium point supported by fundamental supply-demand dynamics.

The International Pepper Community’s latest October report reveals a nuanced global picture, with mixed price movements across producing countries. The primary catalyst driving these variations has been currency fluctuation, as local currencies in major producing nations experience volatility against the U.S. dollar. Exchange rate dynamics continue to play an outsized role in determining competitive positioning and profit margins for exporters across the pepper-producing belt.

Industry data from leading export companies indicates a modest weekly price increase of 0.67%, with prices stabilizing around the 149,000 VND/kg mark. This resilience signals growing market confidence and suggests that the correction phase may be concluding. After months of uncertainty, stakeholders are cautiously optimistic about price sustainability moving into the fourth quarter.

The stabilization comes at a critical juncture for Vietnam’s pepper industry, which has faced mounting pressures from both supply-side constraints and demand fluctuations. Climate variability, disease pressures, and evolving global trade patterns have created a complex operating environment that demands strategic adaptation from producers and exporters alike.

Global Demand Shift: China Emerges as Growth Driver

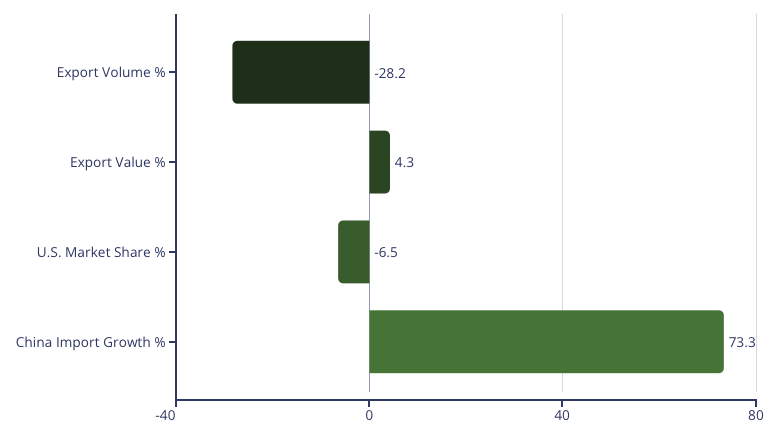

The geography of global pepper demand is undergoing a fundamental transformation, with implications that will reshape trade flows for years to come. China’s dramatic 73.3% year-over-year import increase represents the most significant structural shift in the market, positioning the world’s second-largest economy as a critical growth engine for Vietnamese exporters. This surge reflects China’s expanding middle class, growing food processing industry, and increasing culinary sophistication among urban consumers.

While China’s emergence is capturing headlines, the United States remains the largest single destination for Vietnamese pepper, demonstrating the enduring strength of this bilateral trade relationship. However, the volume decline of 28.2% to 41,800 tons—even as total value increased 4.3% to USD 312.3 million—reveals a market in transition. Higher per-unit pricing has partially offset volume reductions, but the declining U.S. market share from 28.9% to 22.4% of total exports signals the need for strategic recalibration.

The European Union market is also showing renewed buying interest after a period of subdued activity, driven by recovering foodservice demand and restocking by spice processors. Collectively, these three regions—China, the U.S., and the EU—account for the majority of Vietnamese pepper exports and will determine the industry’s trajectory through the remainder of 2025 and into 2026.

Export Performance: Volume-Value Paradox

Vietnam’s pepper export performance during the first nine months of 2025 presents a compelling paradox that encapsulates both the opportunities and challenges facing the industry. Total export volume declined compared to the same period in 2024, yet aggregate export value increased—a testament to improved pricing power and strategic positioning in premium market segments. This volume-value divergence reflects fundamental shifts in global commodity markets where quality, traceability, and sustainability credentials command increasing premiums.

The U.S. market dynamics exemplify this trend most clearly. Despite shipping 28.2% fewer tons to American buyers, Vietnamese exporters generated 4.3% more revenue, achieving approximately USD 312.3 million in export value. This performance demonstrates successful value capture through superior quality positioning, effective branding, and cultivation of relationships with premium buyers in the specialty spice and foodservice channels. The average per-kilogram price realized in U.S. exports significantly exceeded historical norms, partially offsetting volume declines.

However, the shrinking U.S. market share from 28.9% to 22.4% of total Vietnamese exports raises strategic questions about long-term market positioning. While diversification toward China and other emerging markets reduces concentration risk, maintaining strong presence in the world’s largest and most valuable market remains critical. The challenge lies in balancing geographic diversification with the need to protect established positions in traditional high-value markets that have historically anchored Vietnam’s export success.

Structural Challenges: The Cultivation Crisis

While export values and price stability paint an encouraging picture, Vietnam News Agency has highlighted a critical vulnerability that threatens long-term industry sustainability: the widening gap between market success and production investment. Despite generating substantial export revenues, the pepper sector has chronically underinvested in the foundational elements that ensure future competitiveness—particularly seed development, disease resistance research, and climate adaptation strategies.

Climate change has emerged as an existential challenge for pepper cultivation. Traditional growing regions are experiencing unprecedented weather variability, with shifting monsoon patterns, unexpected dry spells, and temperature extremes creating substantial uncertainty for farmers. These environmental stresses not only reduce yields but also compromise quality, affecting the consistency that premium international buyers demand. Without climate-resilient varieties and adaptive farming practices, Vietnam risks losing its competitive edge to countries investing more aggressively in agricultural innovation.

Market Outlook and Strategic Imperatives

Industry analysts project continued price strength through the remainder of 2025 and into early 2026, supported by tight global supply conditions and recovering demand across major markets. The combination of reduced production in key growing regions, improved demand fundamentals, and currency dynamics favorable to Vietnamese exporters creates a supportive environment for price maintenance.

The Import-Export Department at the Ministry of Industry and Trade has characterized the recent U.S. export decline as temporary, primarily linked to tariff adjustments that created short-term uncertainty among buyers. Vietnam’s comparative advantage—including lower tariff rates relative to major competitors Brazil and India, coupled with reliable supply capacity and established quality reputation—positions the country well for export recovery in coming quarters.

Sustaining Vietnam’s position as a global pepper leader requires urgent action on multiple fronts. Public and private sector investment in breeding programs must accelerate dramatically to develop climate-resilient, disease-resistant varieties suited to Vietnam’s evolving agricultural conditions. Technology transfer mechanisms need strengthening to ensure smallholder farmers can access and implement best practices in cultivation, pest management, and post-harvest handling.