2025 // Week 49 – Global Pepper Market Update: Navigating Volatility and Shifting Dynamics

Current Domestic Market: Prices and Dwindling Stocks

As of this morning, pepper prices are holding steady, ranging between VND 150,000 and 152,000 per kilogram, showing little change from yesterday. This stability, however, masks underlying pressures in the market. A critical factor contributing to current market dynamics is the persistent decline in global pepper stocks.

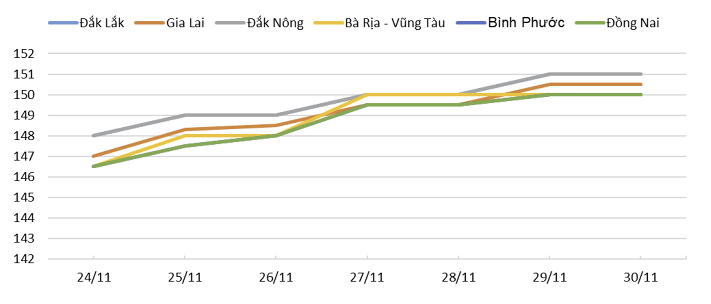

Pepper price developments in the Central Highlands and Southeast regions during the week from November 23 to November 30, 2025 *Source: VPSA

The reduction in available inventory is primarily attributed to a disconnect between production and trade flows: both production volumes and import levels have been insufficient to offset the robust export demands. This imbalance suggests a tightening supply landscape that could influence future price movements despite the current calm.

Production Outlook: Weather Impacts and Global Decline

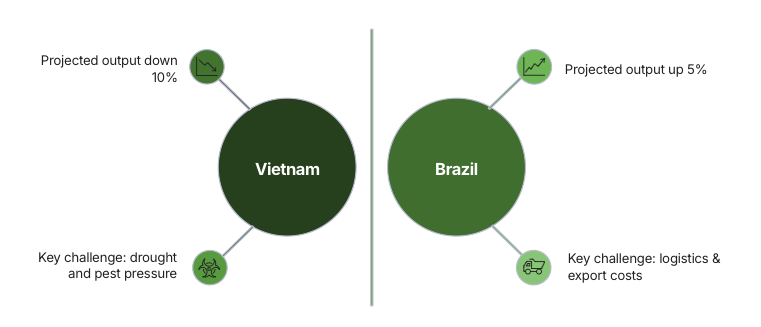

The long-term health of global pepper supply faces significant headwinds. Vietnam, a major producer, is bracing for a reduction in output for the upcoming season. While the planted area remains stable or has seen a slight increase, adverse weather conditions, particularly storms experienced in October and November, are projected to negatively impact the 2026 crop yield, albeit to a modest degree.

This localized challenge in Vietnam mirrors a broader trend observed across the globe. A recent report from a Netherlands-based spice company underscores a broader trend, revealing that global pepper output has declined by more than 30% over the past seven years. While Brazil continues to expand its planted area — projecting an output of 89,000 tons — labor difficulties could hinder the achievement of this target. Meanwhile, other significant producers such as India and Indonesia are also reporting smaller harvest volumes, contributing to tighter global supplies. Indonesia’s production is estimated at approximately 36,000 tons, with available stocks expected to be limited following substantial exports of roughly 45,000 tons released after the 2024 price rally.

Slump in Global Demand and Export Trends

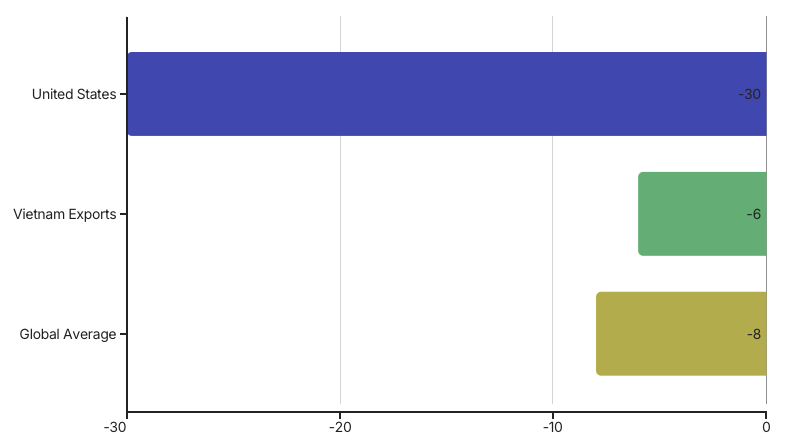

Global demand for pepper has experienced a notable slowdown this year, with the most significant decline observed in the United States. As the world’s largest importer, the U.S. saw a substantial reduction in demand, estimated at approximately 30%. This sharp contraction in a key market has had a ripple effect across the industry.

Consequently, Vietnam, a major global supplier, has seen its overall exports fall by about 6% since the beginning of the year. This decrease in demand, particularly from the U.S., underscores the sensitivity of the pepper market to shifts in consumer behavior and economic conditions in large importing nations.

Vietnam’s 2025 Harvest

Reached 172,000 tons, a 2% year-on-year decrease and a staggering 47% below the 2018–2019 peak. Tropical storms in Oct–Nov are expected to modestly reduce 2026 output, continuing the downward trend.

Brazil’s Expanding Area

Despite an expanding planted area, Brazil’s projected output of 89,000 tons for 2025 could be hampered by ongoing labor difficulties, potentially preventing the country from reaching its full production potential.

Indonesia’s Limited Stocks

Production is estimated at 36,000 tons, but available stocks are expected to be severely limited. This follows significant exports of approximately 45,000 tons released during the 2024 price rally, drawing down inventory substantially.

Executive Order and Shifting Trade Dynamics

A significant development in international trade policy is the recent Executive Order from the White House, effective November 13, 2025. This order specifically exempts certain spices not cultivated in the U.S. from retaliatory tariffs. Crucially for the pepper market, pepper has been placed in Annex II, meaning it will not be subject to any retaliatory tariffs. This regulatory change is expected to stabilize trade flows and reduce uncertainty for pepper importers and exporters.

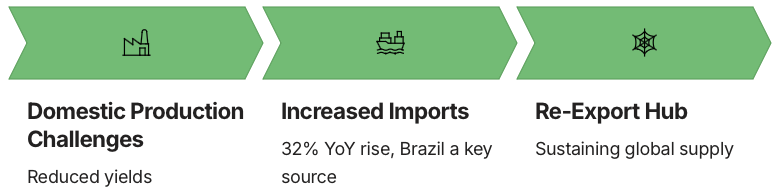

In a notable shift, Vietnam has emerged as a primary destination for increased pepper exports from Brazil. This trend indicates Vietnam’s growing reliance on imports to sustain its re-export activities, adapting to the evolving global supply chain. In the first ten months of the year, Vietnam’s pepper imports surged by 32% year-on-year, totaling 38,000 tons, with imports from Brazil specifically doubling during this period. However, despite these increased imports, domestic stocks continue to shrink, as the combined volume of production and imports still falls short of export volumes.

Vietnam’s Evolving Role: From Producer to Re-Exporter

Vietnam’s position in the global pepper market is undergoing a notable transformation. Despite being a traditional powerhouse in pepper production, the country is increasingly relying on imports to sustain its significant role in the re-export market. In the first ten months of the current year, Vietnam’s pepper imports surged by 32% year-on-year, reaching a total of 38,000 tons.

A significant portion of this increased import volume originates from Brazil, with imports from the South American nation doubling. This trend suggests that while Vietnam’s domestic production faces challenges, its robust processing and export infrastructure allows it to remain a central player by sourcing from other origins. However, the overall balance remains precarious; even with increased imports, national stocks continue to shrink because the combined volume of production and imports still falls short of export demands.

Vietnam’s Harvest and Farmer Sentiment

Vietnam’s 2025 pepper harvest concluded with a total of 172,000 tons, representing a 2% year-on-year decrease and a substantial 47% drop from the peak production levels observed in 2018–2019. This decline highlights the long-term challenges faced by the region’s pepper industry. Furthermore, forecasts suggest that tropical storms occurring in October and November are likely to result in a modest reduction in the 2026 output, signaling continued pressure on supply from Vietnam.

Mid-year price fluctuations in Vietnam were primarily influenced by several factors: uncertainty surrounding trade relations and tariffs with the U.S., domestic VAT complications, and generally weak global demand. However, a recent shift in farmer behavior indicates a potential change in market dynamics. With the coffee harvest now underway in some provinces, providing farmers with immediate cash flow, the selling pressure on pepper has subsided. Farmers in these areas are increasingly choosing to hold onto their pepper stocks, anticipating higher prices in the near future. This strategic holding could further tighten available supply and support price increases.