2026 // Week 3 – Vietnam Pepper Market Insights: The Outlook For Q1 2026

Recent Price Trends and Industry Review

Domestic Price Decline

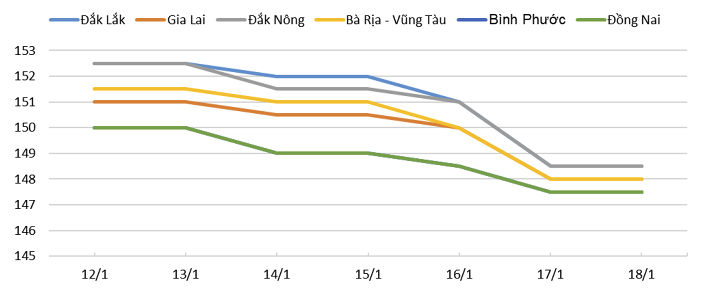

As of the third week of 2026, domestic pepper prices ranged between 149,000 – 151,000 VND/kg, marking an average decline of 1,000 – 2,500 VND/kg. The sharpest drops were observed in key growing regions such as Đắk Lắk and Đắk Nông.

Previous Week’s Uptick

Prior to this decline, the preceding week saw a positive trend, with domestic pepper prices increasing by approximately 1,000 – 1,500 VND/kg, indicating a volatile market.

VPSA Annual Conference

The Vietnam Pepper and Spice Association (VPSA) recently concluded its annual conference, where stakeholders reviewed the industry’s performance in 2025 and discussed future strategies. This event highlighted significant shifts in the global pepper landscape.

Price trends of pepper in the Central Highlands and Southeast regions during the week from 12-January to 18-January.

Global Production Shifts: Brazil’s Ascendance

Brazil emerged as a dominant force in the global pepper market in 2025, demonstrating remarkable growth. Its output reached approximately 81,000 tons, representing a substantial 28.6% year-on-year increase.

This surge in production was mirrored in its export figures, with 83,000 tons exported, valued at an impressive USD 517.8 million. This translates to a 35% increase in volume and an 80% surge in value compared to the previous year. Vietnam notably remained Brazil’s largest export destination, absorbing 26.1% of its total exports, underscoring the interconnectedness of these markets.

Vietnam’s Export Performance in 2025

In 2025, Vietnam solidified its position as a leading global pepper exporter, achieving record-breaking figures. The nation exported a total of 247,482 tons of pepper, generating an unprecedented USD 1.6616 billion in export revenue.

Key Markets & Trends

- The United States remained Vietnam’s largest market, importing 55,082 tons, representing 22.3% of total exports. However, this marked a 23.8% year-on-year decline due to high prices, reciprocal tariff policies, and inventory optimization by US importers.

- Asia emerged as the largest regional destination, accounting for 117,307 tons (47.4% of total exports), primarily driven by demand from the UAE, China, and India.

- The Americas absorbed 60,886 tons (24.6%), while Europe accounted for 54,647 tons (22.1%).

- Africa imported 14,642 tons (5.9%), concentrating on traditional markets like Egypt and North Africa.

Challenges Faced by Key Producers

Indonesia

Indonesia, historically a major pepper producer, encountered significant setbacks in 2025. Adverse weather conditions, including unpredictable rainfall patterns, severely impacted yields. Additionally, persistent plant diseases contributed to production losses, limiting its ability to maintain its market share.

India

India also faced considerable challenges, mirroring Indonesia’s struggles with unfavorable weather. Rising production costs further exacerbated the situation, making it difficult for Indian farmers to compete effectively in the global market. Both nations’ roles in the global supply chain continue to shrink.

Evolving Export Landscape and Strategic Imperatives

Outlook for the 2026 Crop

While Vietnam continues to play a pivotal role in the global pepper supply chain, the outlook for the 2026 crop is viewed with caution. Industry experts anticipate a potential decline in output by approximately 10%.

- Early-Year Drought: Prolonged dry spells at the beginning of the year significantly stressed pepper plants, affecting their growth and fruit development.

- Heavy Rains: Subsequent periods of intense and prolonged rainfall led to waterlogging and increased susceptibility to diseases, further impacting yields.

- Aging Plantations: Many pepper plantations across key growing regions are reaching the end of their productive cycles, contributing to a natural decline in output.

These factors combined underscore the challenges ahead and emphasize the industry’s transition from volume expansion towards prioritizing value and quality enhancement amidst a more complex production environment.