2026 // Week 4 – Vietnam Pepper Market Update: Hovering Around VND 150,000/kg

Domestic Price Stability Amidst Anticipated Harvest Decline

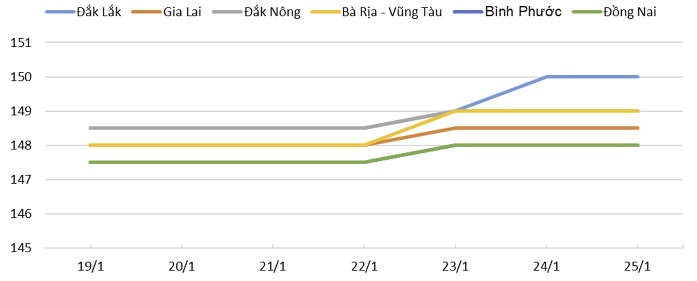

In the early hours today, domestic pepper prices in Vietnam remained stable, holding steady between VND 148,0009 – 150,000 per kilogram. This stability follows a notable increase last week, where prices climbed by VND 500 – 1,500 per kg, indicating an active market leading up to the Lunar New Year (Tet) holiday. The market is generally expected to fluctuate within a narrow range this week, reflecting pre-holiday trading patterns.

Price trends of pepper in the Central Highlands and Southeast regions during the week from 19-January to 25-January.

A significant factor influencing future prices is the approaching 2026 pepper harvest season, set to officially begin after the Tet break. Multiple forecasts point to an anticipated decline in production this year, with estimates suggesting a reduction of 10–15%. This projected decrease in supply could exert upward pressure on prices in the medium to long term, impacting global availability.

Indonesia’s Pepper Production Plummets Due to Environmental Factors

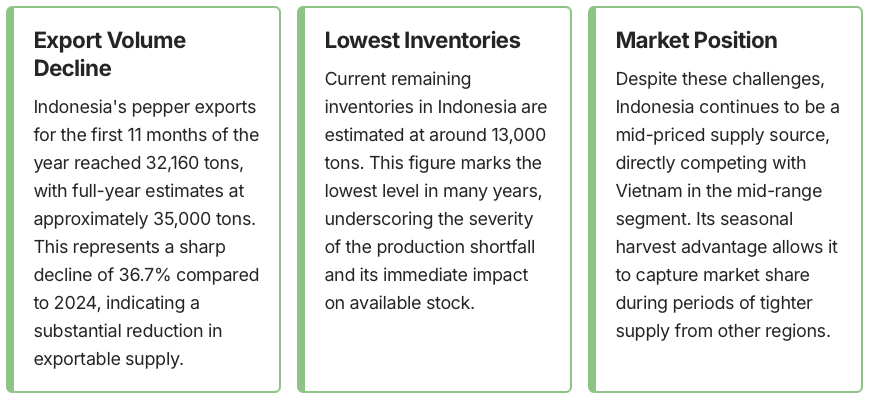

Indonesia, a crucial player in the global pepper market, is facing a challenging production outlook. According to the International Pepper Community (IPC), Indonesia’s pepper production for 2025 is estimated at 53,000 tons, marking a significant year-on-year decline of 10.1%. This reduction is primarily attributed to prolonged heavy rainfall, which has adversely affected crop yields and contributed to a structural reduction in both planted area and overall production efficiency.

Furthermore, the harvest season in Indonesia is expected to be delayed, adding another layer of complexity to supply chain management. This delay, coupled with the overall decline in output, suggests tighter availability from Indonesia in the coming months. The environmental impact on production highlights the vulnerability of agricultural commodities to changing weather patterns and the need for resilient farming practices.

Indonesia’s Export Performance and Dwindling Inventories

Black Pepper: Price Trends and Competitive Dynamics

In Q4 2025, black pepper export prices largely remained above USD 7,000 per ton. However, a downward trend was observed in December as increased export availability entered the market. For the entire year 2025, Indonesia’s Lampung black pepper averaged around USD 7,260 per ton, positioning it higher than Vietnamese black pepper but still below Indian varieties. Prices had peaked around mid-year before easing slightly towards the year-end.

Indonesia’s role as a mid-tier supplier is crucial, offering competitive pricing and leveraging its harvest seasons to gain market share, especially when other major producers like Vietnam experience tighter supply. This dynamic ensures a continuous flow of black pepper to global markets, balancing supply and demand across different regions.

White Pepper: Stable Pricing and Market Leadership

Muntok White Pepper

Prices in Q4/2025 for Muntok white pepper ranged between USD 9,700 – 10,100 per ton, showing a slight downward trend compared to Q3 as new harvest supply entered the market.

Market Stability

Despite the minor decline, white pepper prices remained stable and highly competitive, allowing Indonesia to maintain its dominant position as a key supplier in Asian and Middle Eastern markets.

Pricing Benchmark

The average white pepper price for the full year 2025 stood at approximately USD 10,000 per ton, fluctuating within a narrow range. Indonesia continues to set the global mid-tier benchmark for white pepper pricing, supported by consistent output and relative supply stability.